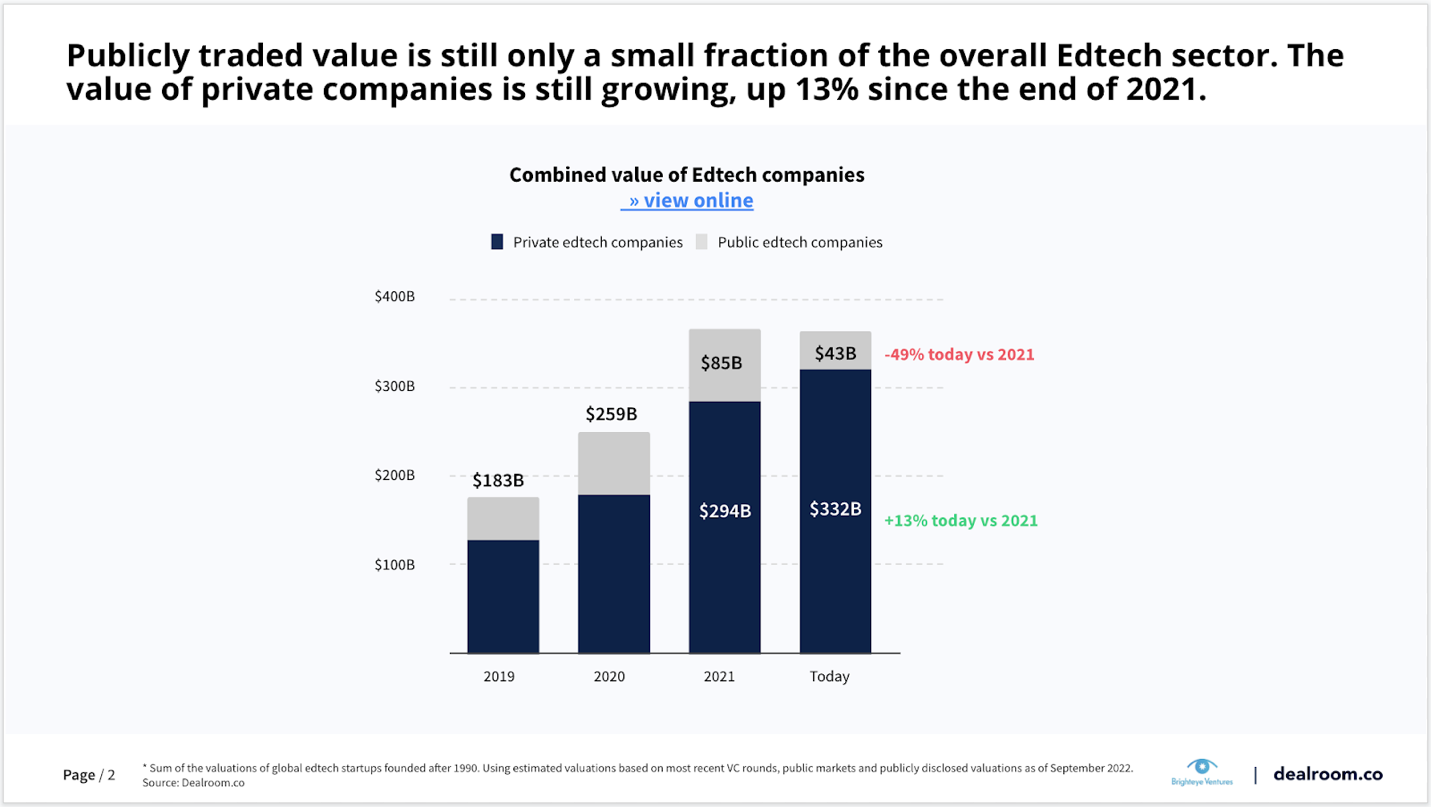

In retrospect, edtech’s spotlight feels like a fever dream. In the early innings of the pandemic, top companies turned into unicorns seemingly overnight as Zoom school became an actual reality for millions across the world, and a frenzy of check-writing seized investors.

Then, we slowly saw the spotlight focus and sharpen. The very companies building for any consumer who needed a better way to learn online began turning to stickier customers — enterprises — for more reliable sources of revenue. The companies that took their first venture capital during the craze decided to join forces with other well-capitalized competitors. And those that raised lots of cash in a short period of time have had to conduct significant rounds of layoffs due to the overhiring that followed.

We’re widening our lens, looking for more — and more diverse — investors to include in TechCrunch surveys, where we poll top professionals about trends and challenges in their industry.

If you’re an investor who’d like to participate in future surveys, fill out this form.

Which brings us to today — and tomorrow. To give TechCrunch+ readers a better understanding of what education investors are looking for today, seven leading venture capitalists in the category answered a series of questions about the sector’s future.

Here’s who we surveyed:

I’ll be honest, the diversity of the answers surprised me — ranging from how climate and workforce mobility are edtech’s next opportunities to how the departure of tourist VCs is playing out differently depending on company stages. The tone also felt balanced: Many admitted that things have changed, but opportunity continues to exist. Like everything these days, the vibe is nuanced.

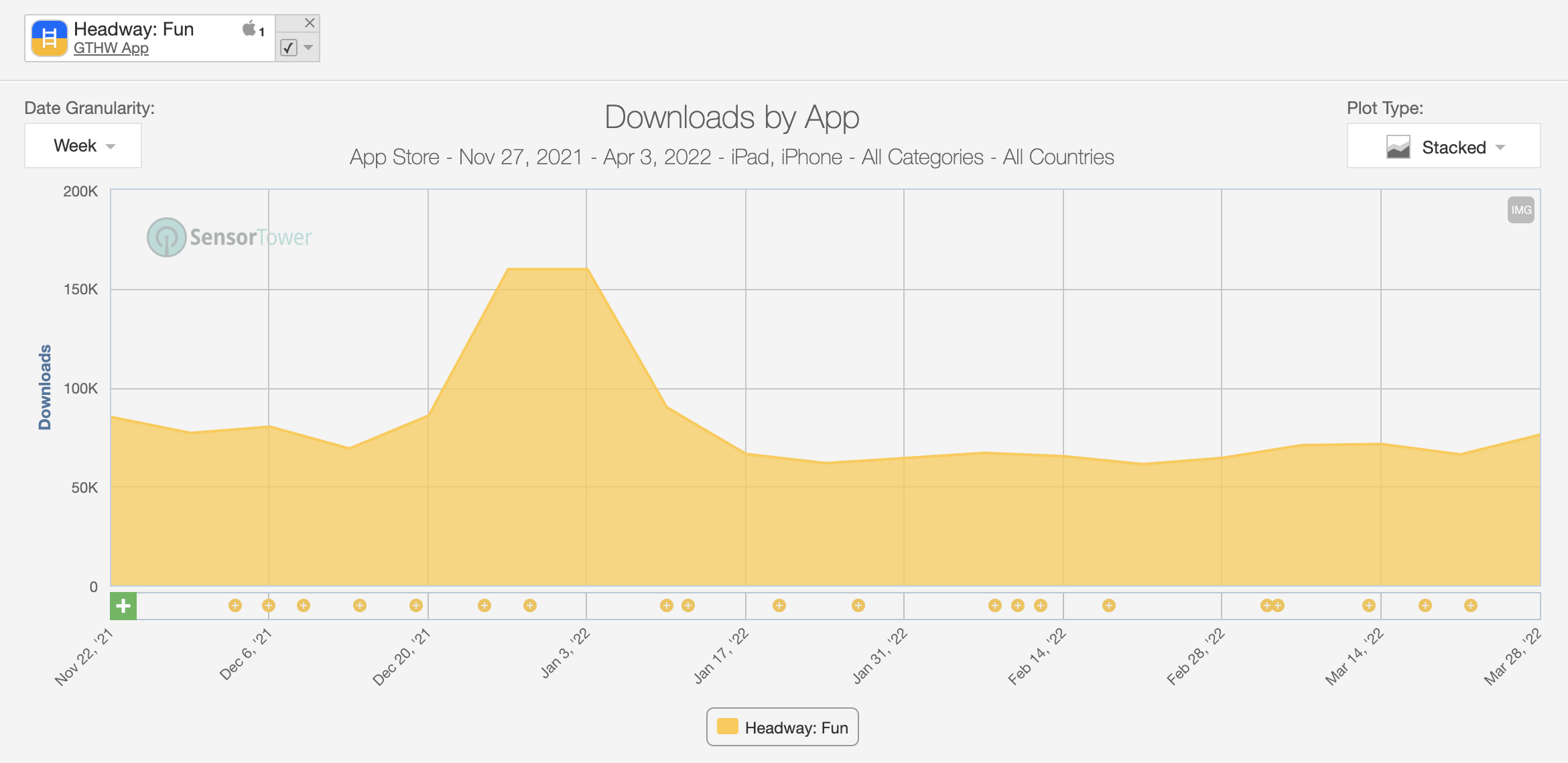

Reach Capital’s Jomayra Herrera encapsulated the changing landscape well: “The deal pace has definitely slowed down in 2022 across most sectors. For context, we were closing a transaction every four days last year, and that has significantly dropped this year given the market conditions. I would say the past few years have been more of an anomaly, and we are getting back to a more sustainable pace.”

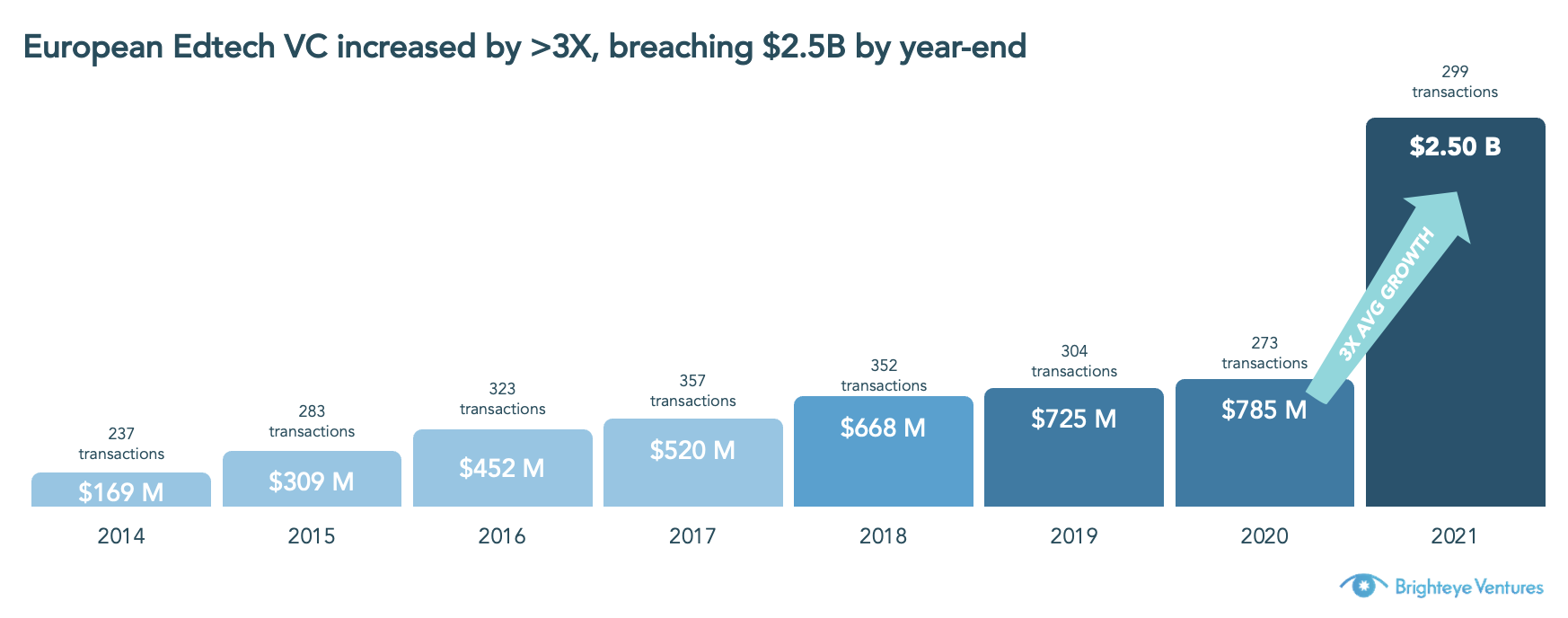

Emerge Education’s Jan Lynn-Matern, meanwhile, was quick to point out that edtech investment in Europe is growing despite the slowdown in the United States — the sector has secured $1.4 billion in Europe thus far in 2022, 40% more than a year earlier, reports say).

Investors are preparing for a time of going heads down, helping their existing portfolio companies that want to prioritize internal growth instead of raising more capital, and rethinking their metrics of success. But that’s all I’m giving away now; read the entire survey to see where investors are finding hope, what is no longer venture-backable, and what wave of edtech innovation they think we’re in today.

Ashley Bittner and Kate Ballinger, Firework Ventures

The early innings of the pandemic netted edtech massive investments of more than $10 billion in venture capital investment globally in 2020 and $20 billion in 2021. But the sector is now facing a downturn. How has this affected your edtech portfolio’s ability to grow, and how are you changing strategy?

It is important to acknowledge that this slowdown looks different from past downturns like the Great Recession. We have not seen a sharp increase in unemployment – as of May 2022, unemployment was just 3.6%, compared to 5% at the start and 10% at its peak during the 2008 recession – largely due to the tight labor market that emerged from the pandemic and the Great Resignation. We still see job openings and turnover at record highs, and many companies are not planning to cut back on hiring, let alone turn to layoffs.

These differences are reflected in the experience of our portfolio companies, many of whom sell into HR and learning and development. In fact, one of our companies had their best quarter on record in Q2.

When it comes to workforce learning, we believe companies are taking a different approach than they did in 2008. During the Great Recession, 1.5 million U.S. workers were laid off across over 8,000 mass layoff events. In an effort to further reduce spending, companies were quick to cut costs in areas like learning and development, which, at the time, were considered less essential.

We now know that decisions like these may have significantly contributed to the massive skills shortage we face today.

Over the past decade, many companies have grown to realize that investing in your workforce is essential to the success of the business – over half of companies facing skills gaps believe internal skill building is the most effective response, compared to one-third who believe hiring is the most effective.

Last year, we were price-disciplined and adhered to our investment strategy as we deployed capital, bringing many of the valuations we’re seeing today in line with our existing philosophy and expectations.

The pandemic’s spotlight on edtech led a slew of generalist investors to start looking at the sector and pouring money into it. This impacted the kinds of startups that got funding and the total capital in the market. Has edtech seen a slowing of the “tourism” from generalist founders and investors? If yes, what is the impact of a more focused sector?

We believe that category expertise is particularly important at the seed and Series A stages. Category expertise is key for an investor to identify product-market fit in the context of the nuances of the sector. We believe there is space for generalist investors to continue investing in the category at the later stages, once product-market fit has been achieved and a company shifts its focus towards scaling.

Edtech activity feels quieter. Is your deal cadence where you expected it to be one year ago? And are the pace of edtech exits today in line with your prior thinking?

Our deal cadence remains unchanged. Firework leads investments primarily at the Series A stage, a strategy that is more concentrated by design (and likely not as adversely impacted by a downturn as other models). We build relationships with founders over time, developing conviction in them, their team, and the company before investing.

This approach allowed us to avoid the investing frenzy of last year. It also means we are not feeling a slowdown in deal cadence this year. We are seeing a lot of companies looking to raise money, and have continued to spend time building relationships with impressive entrepreneurs.

How did the pandemic change your perception of what makes an interesting edtech company? How has that held up when deciding what is considered impressive versus normal growth?

The pandemic has not necessarily changed our thesis, but has accelerated many of its underlying trends. We saw millions of people move to remote work and learning overnight, opening up massive opportunities around remote and distributed training.

The economic recovery from the pandemic has been one of the most unequal in history, with a large number of women and other marginalized groups leaving the workforce altogether. This has only further emphasized the need to build solutions, in edtech and beyond, that are working to close these opportunity gaps.

As a Series A investor, we often look at companies with high growth rates. While strong growth is important, we are focused on ensuring that growth is durable over time. For example, a company could have achieved tremendous growth during the pandemic by tapping into COVID relief funds, but this source of funding may not be stable enough to sustain them for years to come.

What is no longer a venture-backable business model, in your view, in edtech?

We do not have a prediction about any one business model no longer being venture-backable. We continue to look for founders with a high capacity for growth, both personally and for their business, in exciting market opportunities.

What fraction of your companies plan to raise this year? What percent are raising extension rounds and how common is that proving in edtech?

We do not have companies raising extensions of their previous rounds, but we have heard from many founders who are. This move toward extension rounds illustrates a level-setting of expectations from founders around fundraising in the current economic environment.

Understanding the venture context is incredibly important for founders looking to raise capital. We work closely with our portfolio companies ahead of when they are looking to raise their next round to help them understand this context (along with their specific company context), and set goals for the fundraise accordingly.

Some edtech’s unicorns have had to cut staff to deal with the looming recession and the downturn. What should edtech companies do to optimize their runway for the next couple of years?