Financial institutions continue to search for ways to pile into the crypto market, and decentralized finance (DeFi) products are one mechanism that could help them capture share. Investors in DeFi products can earn yield on their capital by lending out their cryptocurrency in exchange for interest.

But DeFi lending is far riskier than traditional lending, in part because of the volatility of the asset class. Just as “high-yield” bonds compensate investors with more cash for betting on riskier-than-average companies, DeFi lending can offer far higher interest rates than the traditional savings account wherein customers essentially lend their money to a bank.

Conduit is building a set of APIs that developers can use to build platforms that provide access to DeFi products. As VP of product at crypto wallet BRD, which Coinbase acquired in November last year, Conduit CEO and cofounder Kirill Gertman experienced firsthand the challenges of finding vendors that would provide the backend tools that his team needed to build its user-facing product. After a stint at Arrival Bank and half a year as product head at consumer fintech Eco, Gertman created Conduit to be the backend solution he was looking for but couldn’t find.

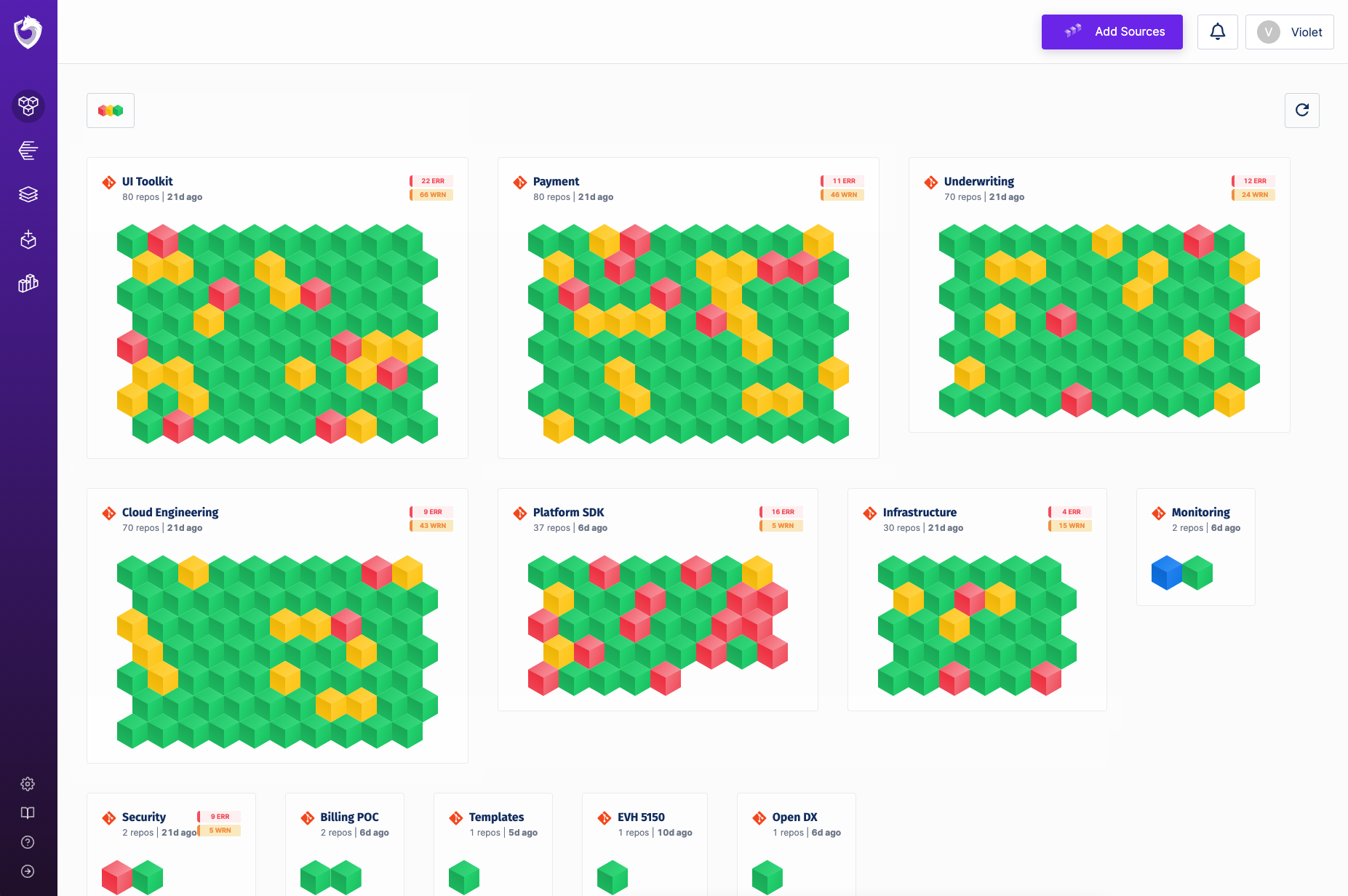

Conduit’s team on a video call Image Credits: Conduit

“When you look at the fintech side of things, there’s already a huge stack that’s been built right to support that. You have Stripe, you have Marqeta if you want to issue cards – any use case you can come up with, you have somebody with an API that’s ready to give it to you,” Gertman told TechCrunch in an interview.

Conduit aims to be a one-stop shop for neobanks and financial institutions to plug their own products into the DeFi ecosystem, which Gertman said is made easier because Conduit itself is regulated and compliant, taking the compliance burden off of companies using its tools.

For consumers to earn DeFi yields, their fiat currency is first converted into stablecoins, a type of cryptocurrency pegged to the fiat currency’s value, so it can be invested into various crypto protocols like Compound and AAVE. Conduit offers two solutions to help companies access these yields.

The first is its growth earnings account, which neobanks offer to customers so they can invest their fiat currency in DeFi. The second is Conduit’s corporate treasury solution, which offers high-yield DeFi accounts to companies.

“We do the ledgering, and we do a lot of stuff that basically creates a very simple bundle for [our clients], so they don’t have to worry about the complexities,” like how to convert dollars to stablecoins or how to calculate rates, Gertman said.

Gertman declined to name specific Conduit customers, but said they fall into two categories – neobanks and small cryptocurrency exchanges, particularly in regions like Latin America. Its largest clients are in Canada, where its product first launched, and Brazil, and it is looking to expand into markets including the US and Europe next, Gertman said.

Gertman sees two types of benefits from the expansion of DeFi products, he said. The first is access – DeFi protocols are permissionless, allowing any user to lend and borrow funds without needing to provide a credit score, identity verification, or collateral. The second is that DeFi connects users globally, allowing investors in countries with extremely low or negative interest rates to earn higher yield, and making it easier for companies to borrow money at favorable rates by drawing from a global liquidity pool, Gertman added.

Conduit says it plans to triple its headcount, which is fully remote, during the next year across the North America and LatAm regions by hiring engineering, sales, and compliance professionals with localized knowledge. Regulation has played a role in which countries Conduit has targeted, he added, saying that a lack of regulatory clarity from the Securities and Exchange Commission (SEC) has slowed Conduit’s entry into the US.

To fuel its global expansion, Conduit raised a $17M seed round led by Portage Ventures, with support from Diagram Ventures, FinVC, Gemini Frontier Fund, Gradient Ventures and Jump Capital, the company announced today. A number of fintech executives also participated in the round, from firms including PayPal, Coinbase, Google Pay, and others.

Conduit bears high legal expenses to ensure it is compliant in all its markets, so Gertman decided the company needed to raise a “larger-than-average seed round,” he said.

“Obviously, the market conditions helped us, and we took advantage of that, and I’m not going to hide that…Even if there will be a crypto winter or something like that, we can survive that,” Gertman said.