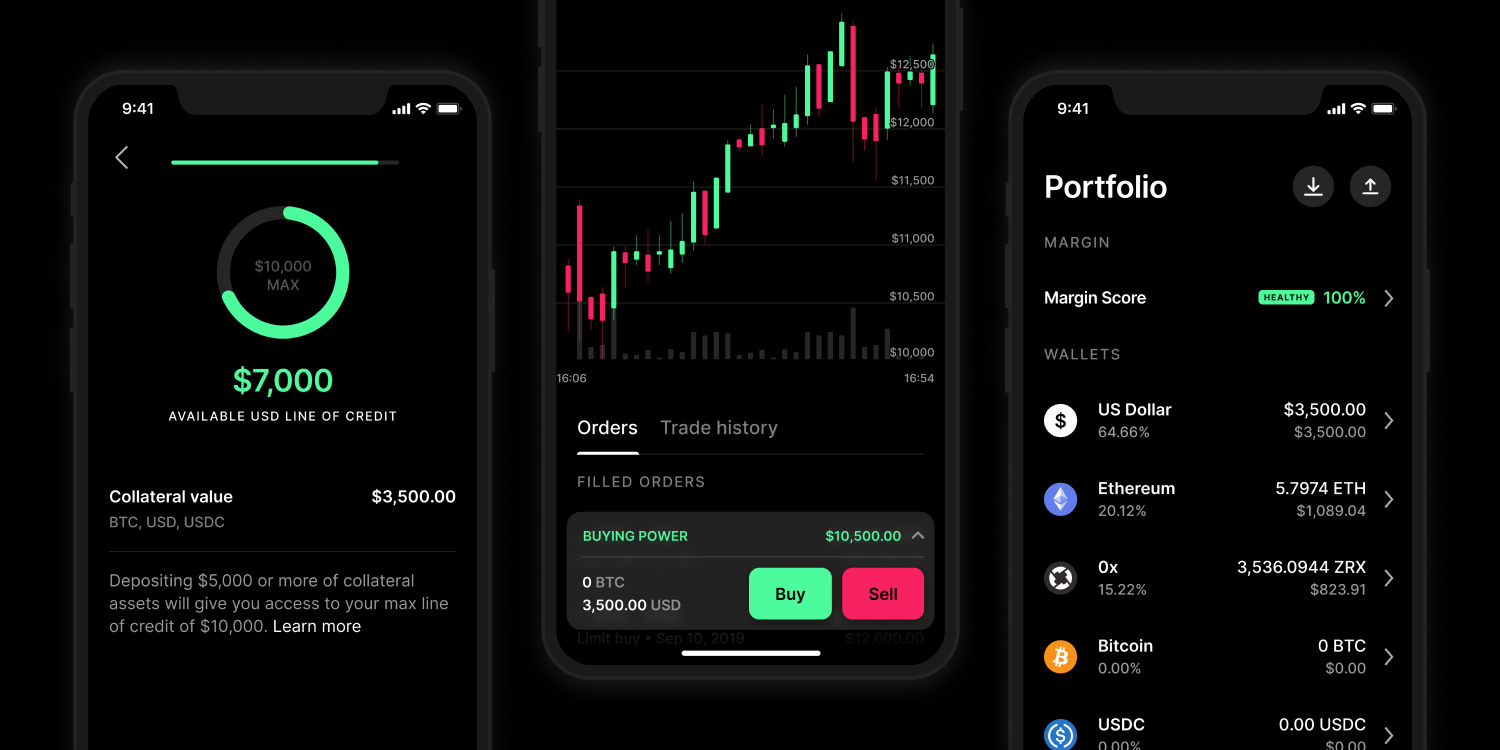

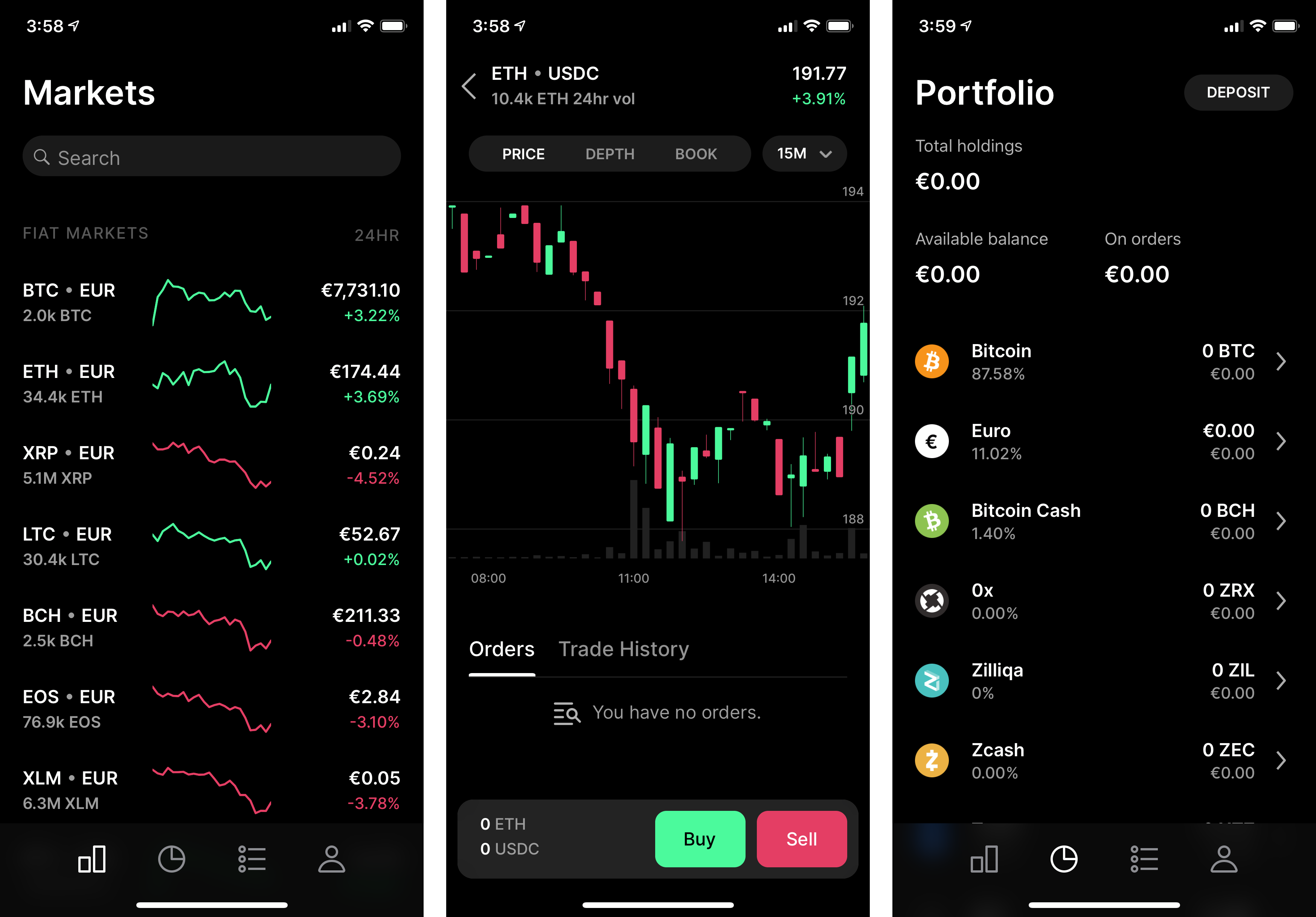

Just a few months after launching margin trading on Coinbase Pro, the company is disabling the feature. Margin trading lets you trade on leverage. But it works both ways — margin trading lets you multiply your gains and your losses.

Starting on November 25, 2pm PT, users won’t be able to place new margin trades. Existing margin positions will expire over the coming days and weeks. Once those positions expire, margin trading will be disabled for good.

The company is following guidance from the Commodity Futures Trading Commission. Interestingly, the CFTC was well aware of the company’s plans to launch margin trading.

Coinbase says it has regular conversations with the CFTC and gives them a heads up about upcoming products and services. The same thing happened with margin trading.

Margin trading hasn’t been available on Coinbase’s main website. It has been limited to some Coinbase Pro users with a cap on the number of users who can access the feature.

And yet, Coinbase wouldn’t have launched margin trading if the company could have anticipated a change of course on the regulatory front. More than 100,000 users signed up to the wait list, indicating some interest from Coinbase’s user base.

But the company has no choice but to end margin trading as it tries to be as compliant as possible with current regulation. Let’s see if other exchanges that operate in the U.S. will follow suit.