Nymbus, a startup that partners with banks to migrate their legacy stack and launch neobanks to attract new customers, today announced that it raised $70 million in a Series D round led by Insight Partners. The Banc Funds Company and Mendon Venture Partners participated also, as did Nymbus clients ConnectOne Bank and PeoplesBank.

According to CEO Jeffrey Kendall, the new capital will be put toward investing in scaling Jacksonville-based Nymbus’ various products and services, particularly its core transaction processing engine and platform for commercial banking,

“While banks and credit unions require a robust technology stack to support operations, the market is limited to options that are often over 30 years old,” Kendall told TechCrunch in an email interview. “In 2015, Nymbus launched its cloud-based core banking platform for financial institutions to provide a robust option for replacing legacy technology and reducing technical debt. The solution has grown over time to streamline operations, offer new routes to growth and enhance the overall customer experience.”

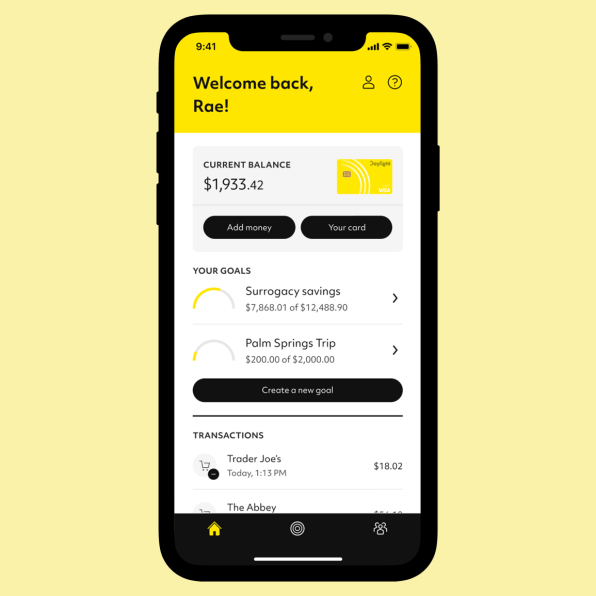

Co-founded in 2015 by Alex Lopatine and Scott Killoh, Nymbus emerged at a time when millennials and Gen Z banking customers began looking to online alternatives to traditional banks — spurred in part by a desire to find better rates. According to a survey from GOBankingRates, nearly 30% of Americans ages 25-34 now use online banks, while 21% of Americans of any age have adopted them.

Banks, unsurprisingly, are feeling the pressure to adapt to a changing world by modernizing and digitizing both their operations and products. But most of them aren’t equipped to do so. According to a 2021 McKinsey study, only 30% of banks that’ve undergone a digital transformation report successfully implementing their digital strategy, and the majority fall short of their stated objectives — whether because of technical debt, siloed IT architectures or an unbridgeable gap between the business and IT departments.

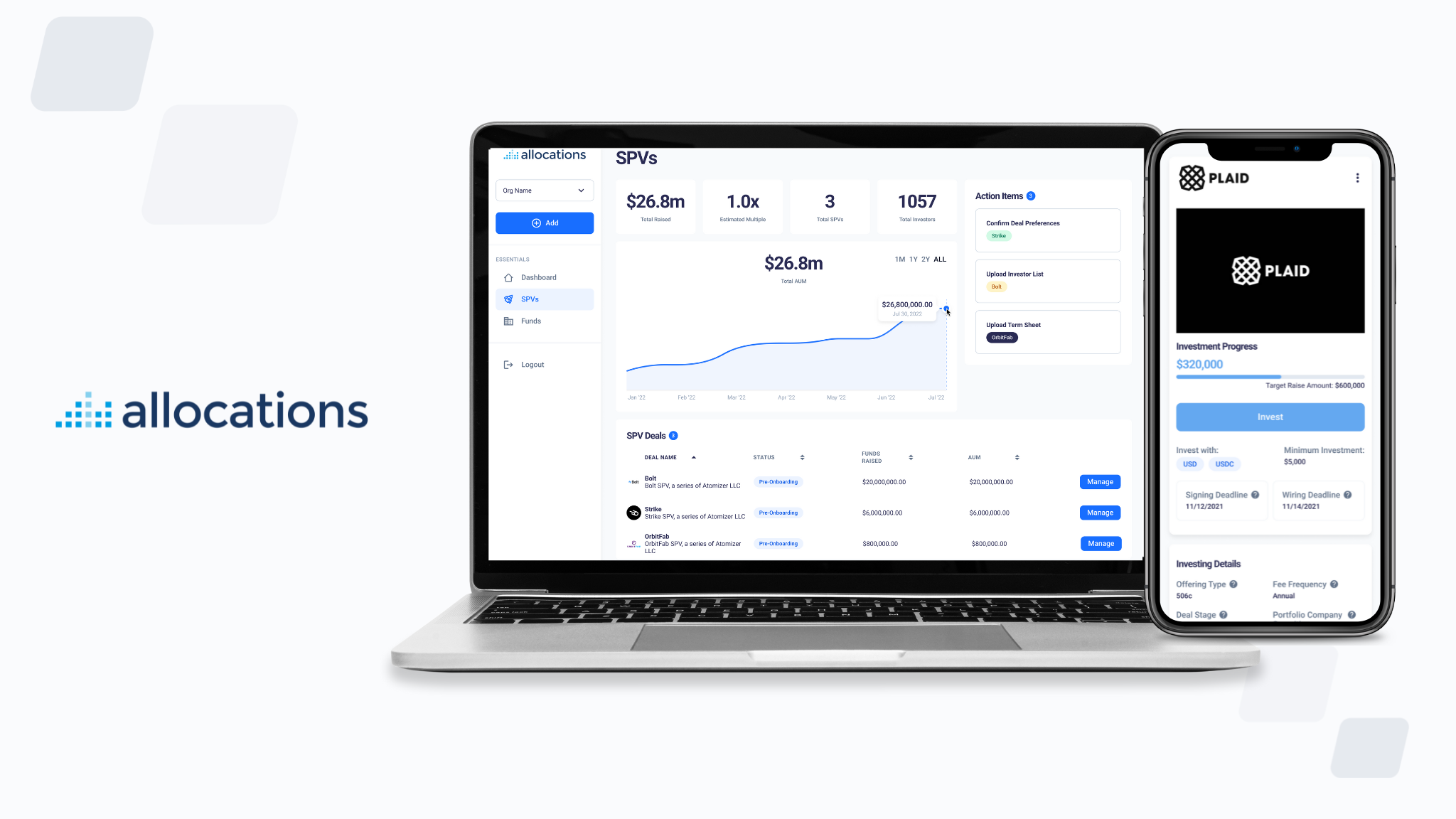

Nymbus aims to boost the success rate with a cloud-based banking solution that offers traditional banks features like API access, event-driven alerting and features, robotic process automation and more. Banks and credit unions can integrate the functions they require to expand their digital capabilities, enhance their back-office processes or introduce new products.

There’s a number of companies that offer this type of “banking-as-a-service (BaaS),” like NovoPayment, a startup based in Miami that’s largely been focused on offering its API platform to customers in the Latin American market. There’s also Bud, which recently raised $80 million to expand its AI-based open banking platform, frequently used by banks to power lending tools.

BaaS has become the industry norm, in fact. A 2022 Finastra poll of U.S. financial institutions and banks found that 86% agree BaaS is already expected by customers, while almost half (46%) have improved or deployed a BaaS solution in the past year. According to one estimate, the BaaS market was valued at around $20 billion in 2021 and could grow over 16% from 2022 to 2030.

But Nymbus stands out for its ability to deliver a “fully managed digital bank,” Kendall says, which includes a “unified data stream” that can be used for data analysis, decision-making and strategic planning. The modular nature of the platform, moreover, can reduce costs without sacrificing “operational excellence,” in Kendall’s words — making it cost effective.

“Nymbus’ product suite, which includes core processing, loan origination, account opening and digital channels, coupled with operational resources, empowers financial institutions of all sizes to tap into new market segments and drive growth,” he said. “Ease of maintenance and speed to market are key for the CIO and this is what the Nymbus solution delivers.”

That’s certainly a lot to promise. And Nymbus, when asked, declined to say how many customers it’s currently serving and its projected recurring revenue, which tends to be a predictor of success (albeit not a foolproof one). Still, despite his reluctance to peel back the curtains on the company’s operations, Kendall asserted that Nymbus — which has around 200 full-time staffers and contractors, currently — is well-positioned to weather headwinds in the coming months.

“The general economic uncertainty and slowdown in tech funding has made securing resources for expansion and innovation more difficult,” he said. “But we have solid solutions in our portfolio to support the growing need of banks and credit unions to modernize and meet their customers where they are — in the digital realm. We believe that as banks increasingly realize the importance of modernization, there will be a continued demand for our services.”

Nymbus lands $70M to help banks digitally transform by Kyle Wiggers originally published on TechCrunch