Osome, a startup that combines multiple corporate services for SMEs into one “super app,” has raised a $16 million Series A. The round included returning investors Target Global, AltaIR Capital and Phystech Ventures, and new backers S16VC and venture capitalist Peng T. Ong, who joined as an angel investor.

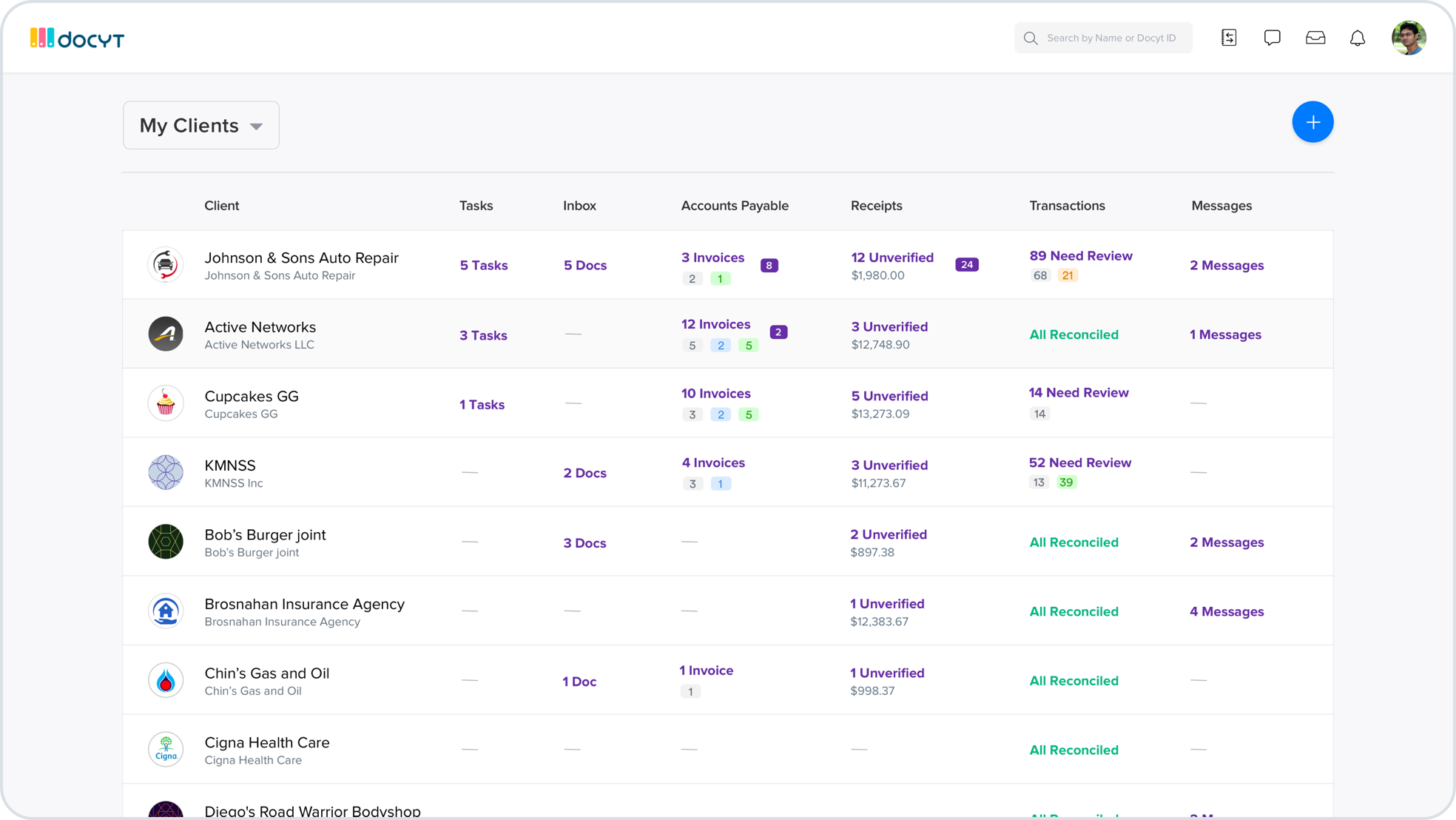

The Singapore-based startup’s last funding round was $3 million announced in November. Its Series A brings Osome’s total funding since it was founded in 2017 to $24.5 million. It now claims to be used by 6,000 companies in Singapore, the United Kingdom and Hong Kong, giving it $9.5 million in annual recurring revenue and 100% year-over-year revenue growth.

Its Series A will be used on international expansion and product integrations. Osome, which employs a total of 200 people, has seen fast adoption by e-commerce companies in particular, and plans to launch more products and apps for the sector over the next 18 months.

Co-founder and chief executive officer Victor Lysenko told TechCrunch that the company started “looking at the e-commerce segment some time ago, but wanted to be confident that our product can handle the increased complexity and transaction volume of e-commerce businesses before launching marketing. The pandemic has caused the e-commerce industry to grow significantly faster and that was also a factor for us.”

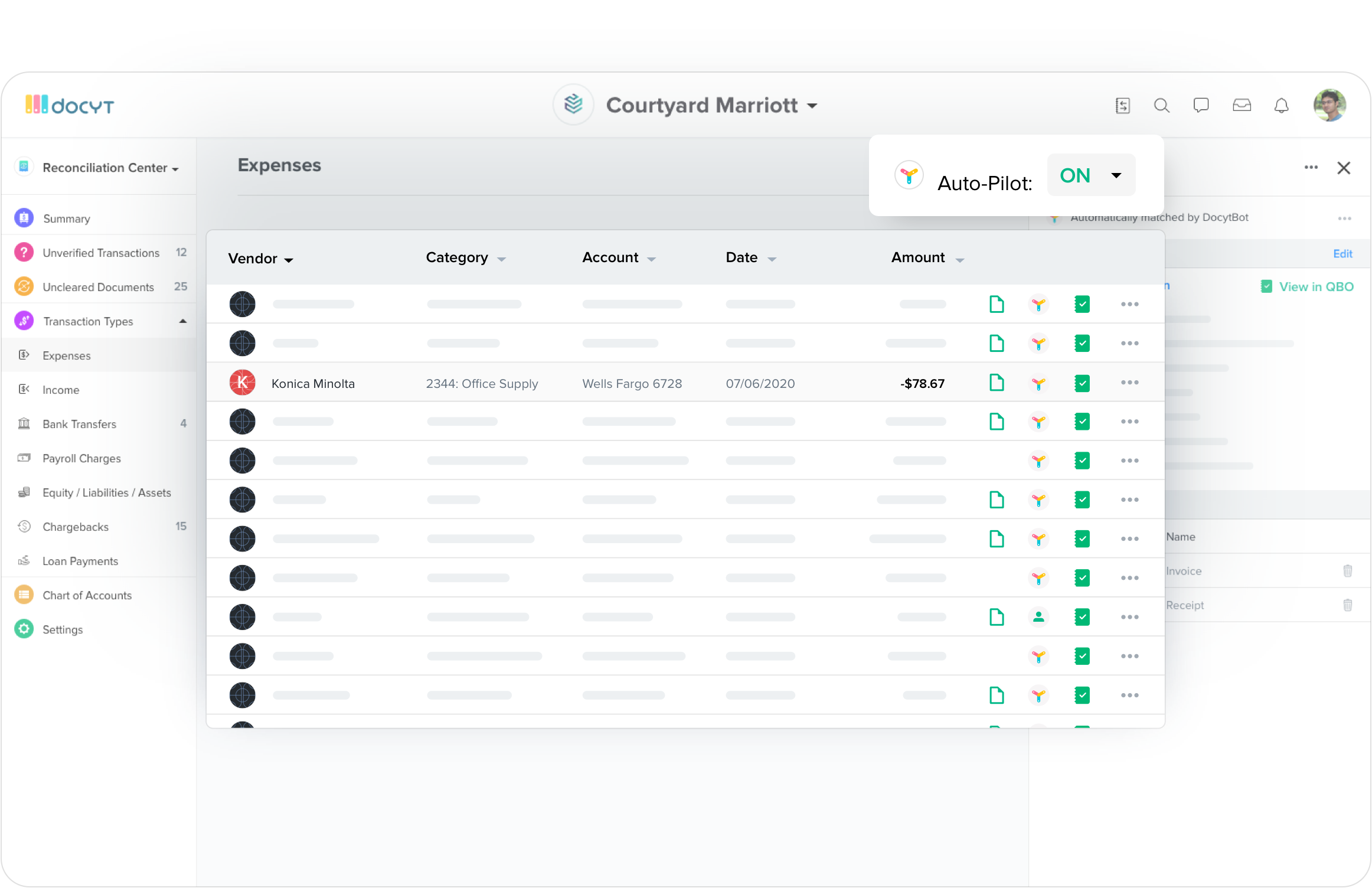

He added that Osome will add integrations with multiple e-commerce platforms and administrative services, with the goal of cutting hours out of the time e-commerce company owners spend on accounting each week.

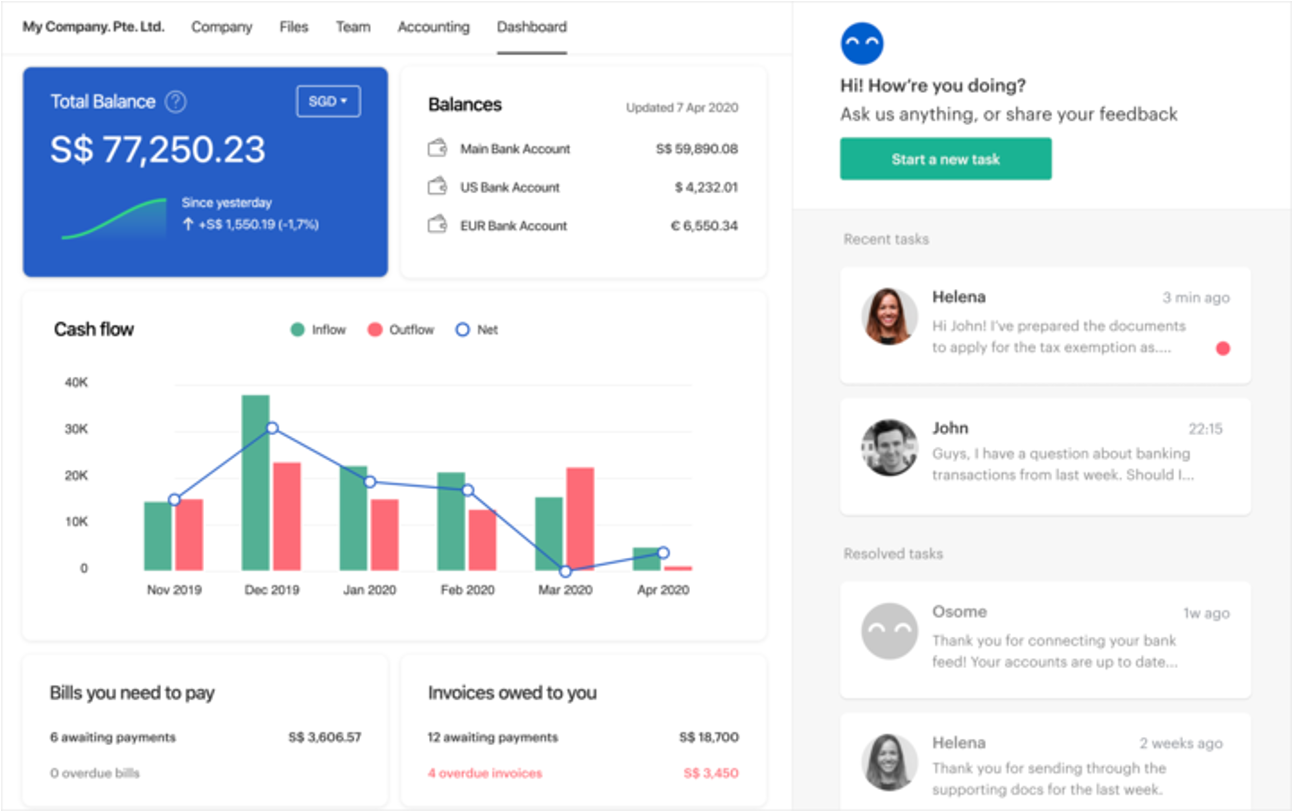

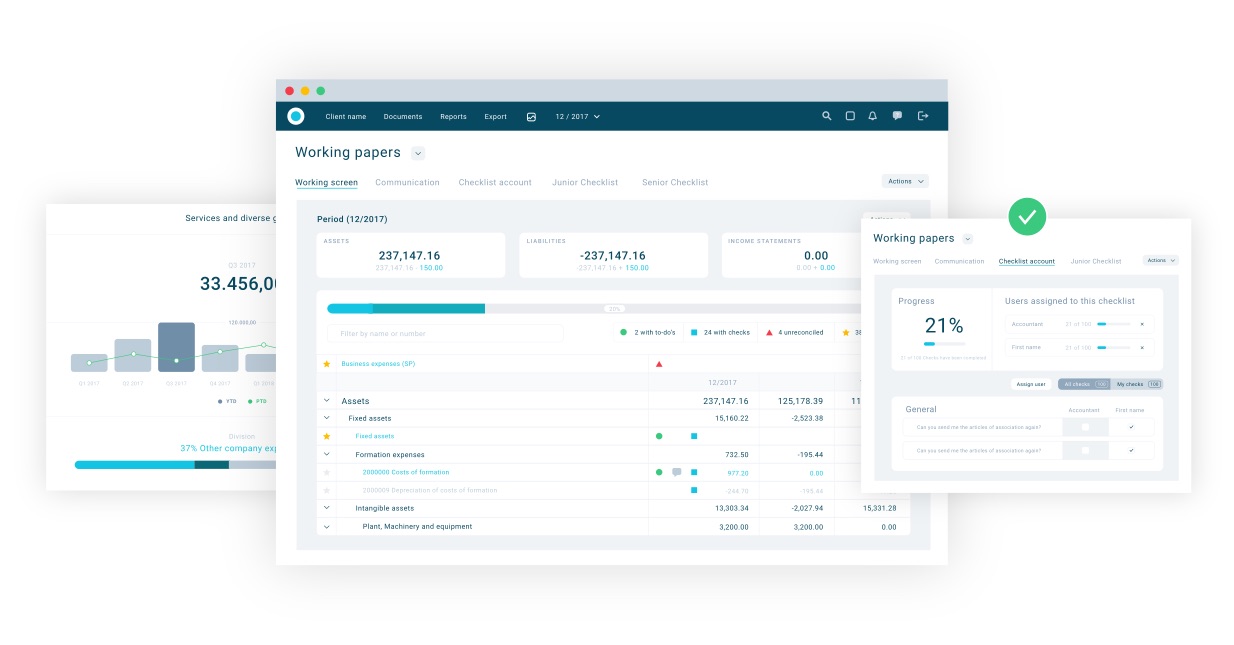

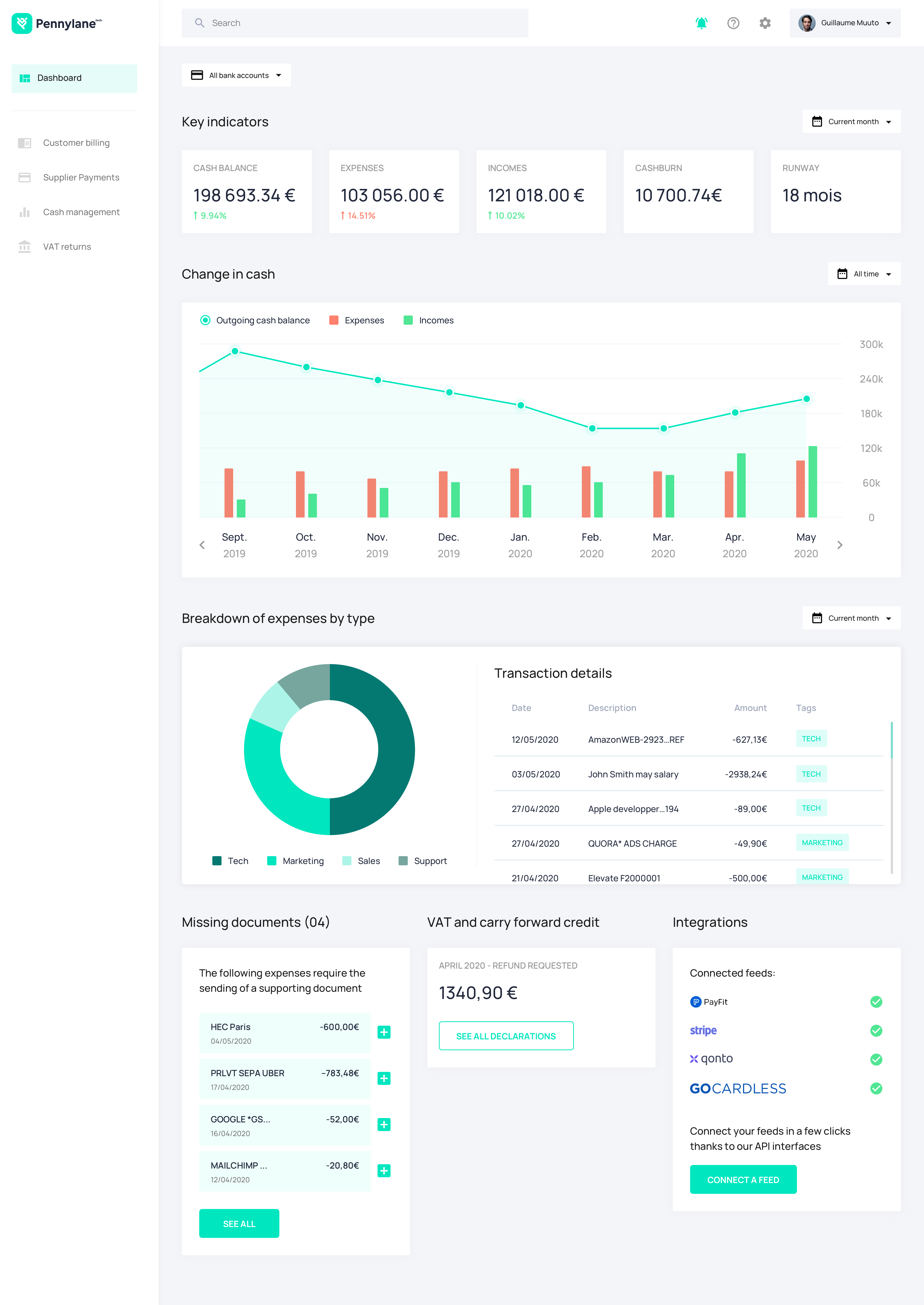

Osome’s flagship product is online accounting services for SMEs, connecting companies with chartered accountants. It also offers corporate secretary services, including business registration, compliance and taxation. The platform uses machine learning tech to automate many tasks—for example, it categorizes, tags and stores documents, creates management reports and tax returns and files paperwork on time.

Lysenko said entrepreneurs on average spend 68% of their time dealing with back-office tasks, instead of strategizing their company’s goals. Osome is meant to reduce the burden of administrative work on small businesses and demand for its services grew during the pandemic as companies moved more of their operations online.

Singapore makes it relatively easy to incorporate businesses online, so several other startups in the same space are based there. These include Sleek, Lanturn and BlueMeg, all focused on automating accounting and other time-consuming tasks for SMEs.

In a statement about the funding, S16VC co-founder Aleks Shamis said, “I’ve done business with small and medium e-commerce in 10 countries and see the same inefficiencies in manual accounting across all of them. It is a real problem that will definitely be solved, and Osome is technologically and traction-wise among the few companies in the world in getting there.”