FlowFi combines technology with financial experts to go beyond traditional bookkeeping to show founders essential non-GAAP financial metrics.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

FlowFi combines technology with financial experts to go beyond traditional bookkeeping to show founders essential non-GAAP financial metrics.

© 2024 TechCrunch. All rights reserved. For personal use only.

A company starting from scratch today is probably going to use a stack of financial software with the most modern fintech tools. These could be things like Stripe for payments, Brex for corporate credit cards and Gusto for payroll and benefits, among others that when combined can provide a unique view into a company’s financial health.

Puzzle, an early-stage startup, is building an accounting package aimed at taking advantage of the data streaming from these tools. Today, the company is making its public debut, while announcing a $15 million Series A.

Sasha Orloff, CEO and co-founder of Puzzle, calls his company “the first smart accounting software,” which combines a streaming financial data platform that’s connected to a general accounting ledger.

“By combining these two things, we can create a whole new set of capabilities for an organization across fundraising, taxes and understanding the complete picture of financial health [at a startup], Orloff told TechCrunch.

The streaming piece is possible because of the ability to connect to things like payment and payroll data in real time and update the ledger with the most recent information. Instead of compiling this data on a monthly basis, the company can have the most current information at its fingertips at all times, and that can be a real advantage, according to Orloff.

“We pull natively off of that modern stack to create this single place where a company can see all of their data and how these things kind of fit together to then create a picture of your financial health. So it’s like a complement to all of the modern innovation that has been happening,” he said.

Ultimately, Orloff wants to be more than an accounting software service for startups, but he calls that a starting point for the company. He says that the goal is eventually to replace traditional ERP (enterprise resource planning) software with this “API-enabled data platform that’s connected to all of the best solutions in the market, not just what happens to be bundled together in the [vendor’s] API.”

The company launched at the end of 2019, and has been working with more than 500 startups over the years to build and refine the new software. Today the company is emerging from beta with a service that is generally available to any interested customer.

Puzzle currently has 30 employees and plans to hire with the money. Among his staff are several people with the unique combination of accounting and engineering knowledge, but he says that he will need people across the board as he scales the startup.

The $15 million investment was led by General Catalyst, with participation from more than 100 industry angels, including CFOs at venture-backed startups. Today’s round closed at the end of last year, and the company has now raised $20 million, including a $5 million seed also led by GC, according to Orloff.

Puzzle is building a modern accounting package for today’s API-enabled startups by Ron Miller originally published on TechCrunch

Until recently, tech startups traditionally enjoyed relative freedom from financial oversight from the venture capitalists who funded them.

As long as these firms could report progress in developing their products and generating some level of earnings from sales and software subscriptions, they could burn through their millions without having to endure close scrutiny of their expenses.

But this laissez-faire era is coming to a close. With inflation, rising interest rates and lower earnings expectations battering technology stocks this year, we may be in the midst of another tech bubble burst similar to the one at the beginning of the century.

In this environment, many of the “pie-in-the-sky” companies that angel investors were flocking to are now struggling to survive. Many VC funds are refocusing their investments on more well-grounded technology companies focused on solving real-world problems.

Passing yearly audits will no longer be enough. Investors now expect these startups to demonstrate greater financial transparency all the time. CEOs who once got away with marketing themselves as visionaries will also need to think and act like accountants.

You don’t want to run your business by your bank balance, but if you’re a tech firm that isn’t yet profitable, you need to keep tabs on your balances.

This means they’ll no longer be able to get away with manually filling in spreadsheets on an ad hoc basis whenever they have a spare moment. They’ll need to have robust bookkeeping processes and tools to track and report expenses and revenue in a more accurate and timely manner. And they need to maintain accurate records of revenue and earnings coming in each month, if not every day.

While most startup CEOs have a basic understanding of accounting principles, many don’t have the training needed to serve in this role, or simply don’t have the time or desire to do so. But with more VC funds wanting to see where every dollar is spent, it is essential CEOs understand how to accurately track and report monthly expenses and revenue.

Use one tool to sync your accounting platform with any wire transfers, checks or ACH payments your business needs to make. Online banking services like Relay Bank or Bill.com are useful.

You don’t need multiple ways to pay and want to prevent using anything that prevents payments from instantly showing up in your books. I’ll explain why this is critical further on.

Many SaaS companies will hold a significant amount of credit card charges. You’ll want to start using a Divvy or Brex card that allows you to segment and issue cards by department and apply spending limits to help enforce monthly or department budgets.

Amex cards are enticing because of the rewards and points, but they make it hard to track employee spending in real time.

The beauty and wellness industry, annually worth some $4 trillion, is underpinned by tens of thousands of businesses and millions of professionals carrying out haircuts, treatments and workouts. Today, a company called Fresha, which provides a software stack to help them run those operations, is announcing new funding of $52.5 million to continue building out its own business.

Fresha got its start, and is best known among its 60,000 customers, for its booking software, which it provides on a subscription-free basis, charging instead based on taking a cut on payments, or first-time bookings and marketing messages (if a customer chooses those latter two options). But its ambitions, co-founder and CEO William Zeqiri said in an interview, are to be the go-to destination for any digital tool that a salon or independent professional might need to run a business: like Shopify, LinkedIn, Wix, Square or QuickBooks, but tailored for the specific demands of beauty and wellness professionals.

“Stylists [and other beauty and wellness professionals] are not really trained in business management,” he said. “Our goal is to free that up and automate all aspects of their business.”

Michael Lahyani and BECO Capital co-led the round, with previous backers General Atlantic, Partech, Target Global and FMZ Ventures also participating. Fresha has raised $182 million overall.

This latest funding is coming in the form of a Series C extension — Fresha raised the first $100 million in June of this year — and with it, the startup’s valuation has shot up to over $640 million. For context, the company previously had not disclosed its valuation, but Zeqiri confirmed that it increased significantly in the extension due to the company’s own growth in the last six months.

Beauty and wellness had a mixed bag of luck as the pandemic took hold across the world. People overall were going out a lot less, or not at all, and thus spending significantly more on products to treat themselves at home. But on the other hand, Covid-19 led to a lot of municipalities shutting down salons to help curb the spread of the virus; and in cases where they were open follow more restrictive protocols for the customers who did show up.

That presented an obvious challenge to a company like Fresha, built around the premise of providing appointment booking and payments for in-person, very physical businesses. However, like other tech companies that have carved out a niche for themselves in providing tools specifically catering to and mastering the needs of a specific service-industry vertical — Toast being on strong example — Fresha’s focus helped it identify the opportunity inherent in that challenge.

Today, Fresha’s tools include booking and point-of-sale payment software — used in some 120 countries with its biggest markets the U.S., the U.K., Canada, Australia, New Zealand and Europe, where it sees tens of millions of appointments booked monthly and has processed $15 billion in transactions to date.

But Zegiri said that with the big shift among Fresha’s customers to move more interactions and services online in the wake of Covid-19, Fresha has built a “Shopify” for beauty and wellness websites to sell goods and services (this is launching in the coming days). It’s now in the process of finishing up its “Wix” for designing sites.

“We want to build the Amazon of the beauty and wellness industry, with a full suite of services that compete at every level, and in all markets,” he said. That will include marketing, and marketing automation tools, and more down the line, he said. It will in the meantime face a pretty big army of competitors, from Square through to Booksy, Phorest, Treatwell, SalonIQ and many others.

There has also been an interesting shift in the business models around beauty and wellness that has also played into Fresha’s hand, said Nick Miller, the company’s other co-founder and chief product officer.

Specifically, the pressures of the pandemic forced a lot of salons and brick and mortar businesses to downsize; or sometimes shut down altogether and “go mobile” where pro’s paid people home visits to carry out services.

Or, in cases where they were willing to stick it out and continue paying rent on premises, increasingly there was a move to models where pros were no longer directly employed by salons and spas, but rather hired out space within them to serve their own client lists; or some variation on that theme, for example staying on the books as contractors and sharing a common appointment book, but still “renting” the space to carry out work.

All of this presents a complex mix of new use cases, and customers, to sign on to a platform like Fresha’s, Miller noted.

“That’s been one of the Covid effects,” he said. And because its users are not tech-interested in the main, the idea of using multiple services for different aspects of running their businesses, and “jumping to different platforms,” in his words, they appealed to Fresha to bring in the functionality that they wanted to have. “It was great timing for us,” Miller said.

Sadly, one of the other consequences of the pandemic has been the closure of a lot of small and independent businesses. Zeqiri noted that Fresha has had multiple offers from its customers to buy them up, but that’s not the core of how the startup sees itself growing: its aim is instead to build tools to make those businesses viable again, he said.

“Fresha has positioned itself as a major player in the beauty and wellness industry with a large and loyal customer base,” said Aaron Goldman, global co-head of financial services and MD of General Atlantic, in a statement. “We strongly believe in Fresha’s balanced strategy of providing one of the best products in the market at no cost to salons and then driving monetization via payments and value-added services.”

Square’s popular free invoicing software is becoming the company’s next big subscription service. The company is poised to announced a paid subscription offering called Invoices Plus, which will offer sellers a set of advanced features, including some that had previously been available with the free service. The service itself had been quietly introduced to individual sellers, but has not yet been publicly announced.

Some sellers who were already using Square Invoices were recently alerted to the upcoming changes via email.

In the announcement shared with some sellers (the details of which can also be viewed here on a Square Seller Community forum), the new subscription will include a series of features that were released in the past year as part of a limited trial.

This includes multi-page estimates, custom invoice templates, and custom invoice fields. These will now become a part of Invoices Plus, as will two other features: the ability to automatically convert accepted estimates to invoices and the ability to build milestone-based schedules (three-plus installment invoices). Square’s announcement said it will introduce a “trial” button next to these features in the Square Invoices software to alert customers to the upcoming capabilities. (see below)

Image Credits: Square website

Square’s free invoicing software will not go away, the announcement noted. Sellers will be able to send unlimited invoices for free, as well as estimates and contracts, with the free plan. Free users will also be able to use invoice tracking, reminders and reporting tools.

The free plan has historically relied on processing fees to generate revenue. At present, this is 2.9% + $0.30 per invoice paid online by check or debit card plus a 1% fee per ACH transaction, per Square’s website. (Fees are slightly lower on in-person transactions and slightly higher for “card on file” transactions.) Pricing for the new, paid subscription has not yet been publicly announced.

A Square employee had explained the reasoning behind the change on the community forum site. They noted that many of Square’s other products — like Square Online, Appointments, Square for Retail, and Square for Restaurants — also offer both a free and paid tier. And although Square charges processing fees for Square Invoices, they aren’t enough to fuel its product development. With Invoices Plus, they said, the company aims to compete more directly with paid invoicing apps and products and the more advanced features those products offer.

Reached for comment, Square confirmed to TechCrunch Invoices Plus is a software subscription the company plans to announce shortly. But the company didn’t want to share more details until the news is official.

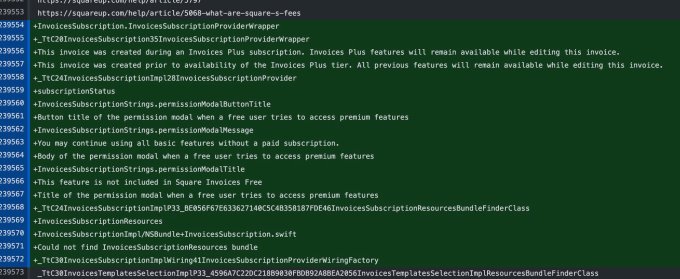

References to the new subscription have also already made their way to the Square app’s code, where they were spotted by iOS developer Steve Moser. The code indicates users who previously used some of the paid-only features will be able to still use them for the time being. But as the announcement had also noted, sellers would not be able to use the paid features for free the next time they’re creating new files with Square Invoices.

Image Credits: Steve Moser

The new service arrives shortly after Square announced earnings, where it noted its seller business brought in $1.31 billion in revenue (out of the total of $4.68 billion) and $585 million of gross profit in the second quarter, driven in part by continued strong online growth. The company also announced its plan to acquire the buy now, pay later giant Afterpay in a $29 billion deal, speaking to its interest in chasing the broader payments market. The deal also offers Square a way to connect its different products, by allowing Afterpay customers to pay their monthly installments through Square’s Cash App, the company said.

An integration between Square and Afterpay is something that could be seen further down the road, as well, one could imagine. That’s something Square also hinted towards in a response to another seller on its community forum site, where a rep updated an older answer to share news of the acquisition, adding Square didn’t “have integration timelines to share at the moment.”

FreshBooks, a Toronto-based cloud accounting software company focused on SMBs, announced today it has secured $80.75 million in a Series E round of funding, as well as $50 million in debt financing.

Existing backer Accomplice led the equity financing, which the company described as “an inside round” that propelled FreshBooks to unicorn status with a valuation of “over $1 billion.”

J.P. Morgan, Gaingels, BMO Technology & Innovation Banking Group and Manulife also participated in the equity investment, along with platform partner and new backer Barclays. With the new capital injection, FreshBooks has now raised a total of more than $200 million in funding over its lifetime.

FreshBooks has built a cloud-based accounting software platform designed to make things like invoicing, expenses, payments, payroll and financial reporting easier for small business owners and self-employed people (and their clients). The company, which says it has served more than 30 million people in over 160 countries, was bootstrapped for the first decade of its life.

As in the case of many startups, FreshBooks was started to solve a pain point for one of its founders. In 2003, FreshBooks’ co-founder Mike McDerment was running a small design agency. When it came to billing clients, he found Word and Excel frustrating to use and felt like they weren’t built to create professional-looking invoices. So he coded his own solution that became the foundation of what is now FreshBooks. The company was self-funded until 2014, when McDerment decided to bring on outside investors and raised $30 million from Oak Investment Partners, Accomplice and Georgian Partners.

In 2019, Don Epperson joined FreshBooks as executive director before transitioning to the role of CEO this year. McDerment, who previously held the position, remains as executive chair of the company.

FreshBooks has 500 employees in Canada, Croatia, Mexico, the Netherlands and the United States — hiring over 100 people in the past year. Also in the last year, the company entered the LatAm market after acquiring Mexico-based e-invoicing company Facturama in September 2020 in an effort to expand its audience in Spanish-speaking markets.

FreshBooks plans to use its new capital toward sales and marketing, research and development and additional strategic acquisitions.

The company will also use its new funding toward investing in markets that are becoming more regulated and helping owners manage their finances through “simplistic workflows,” according to Epperson.

For example, he said, more business owners are working to become digitally enabled to meet local tax and invoice compliance systems.

“The need for owners to manage their business digitally has accelerated, and this has changed how small business owners work with bookkeepers and accountants,” Epperson told TechCrunch. “The funding comes as an injection of confidence in our mission to digitally enable small businesses.”

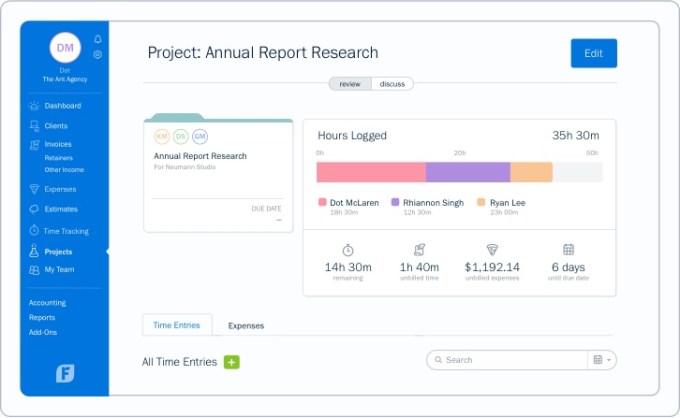

Image Credits: FreshBooks

When it comes to growth metrics like year-over-year revenue percentage growth, the exec was tight-lipped, saying only that FreshBooks has “seen significant growth” in the number of new customers since last year, in part fueled by a pandemic-driven increase in new small businesses.

The pandemic also uncovered the need for us to understand how seismic events affect our customers, Epperson said.

“After analyzing FreshBooks’ own proprietary data, we learned that businesses owned by women were taking three times longer to recover in the U.S. versus businesses owned by men,” Epperson said. “This stat laid the foundation for conducting more research into how the pandemic was affecting businesses across multiple industries and entering into data-sharing partnerships with local governments to help policymakers enact change in the support available to small business owners.”

Jeff Fagnan, founder and managing partner at Cambridge, Massachusetts-based Accomplice, is clearly bullish on FreshBooks’ potential, saying of his firm’s continued investments in the Canadian company over the past seven years: “With more people choosing self-employment, the FreshBooks team fundamentally believes in the growth of small businesses, and the importance of helping these businesses scale. As insiders, we have better context for how the company is scaling and how the market is growing, and this is why FreshBooks is our largest investment to date.”

FreshBooks is the latest in a growing number of Toronto-based unicorns. Late last month, 1Password raised $100 million in a Series B round of funding that doubled the company’s valuation to $2 billion. 1Password first became a unicorn in 2019.

Accounting isn’t a topic that most people can get excited about — probably not even most accountants. But if you’re running any kind of business, there’s just no way around it. Santa Clara-based Docyt wants to make the life of small and medium business owners (and their accounting firms) a bit easier by using machine learning to handle a lot of the routine tasks around collecting financial data, digitizing receipts, categorization and — maybe most importantly — reconciliation.

The company today announced that it has raised a $1.5 million seed-extension round led by First Rays Venture Partners with participation from Morado Ventures and a group of angel investors. Docyt (pronounced “docket”) had previously raised a $2.2 million seed round from Morado Ventures, AME Cloud Ventures, Westwave Capital, Xplorer Capital, Tuesday and angel investors. The company plans to use the new investment to accelerate its customer growth.

At first glance, it may seem like Docyt competes with the likes of QuickBooks, which is pretty much the de facto standard for small business accounting. But Docyt co-founder and CTO Sugam Pandey tells me that he thinks of the service as a partner to the likes of QuickBooks.

“Docyt is a product for the small business owners who find accounting very complex, who are very experienced on how to run and grow their business, but not really an expert in accounting. At the same time, businesses who are graduating out of QuickBooks — small business owners sometimes become midsized enterprises as well — [ … ] they start growing out of their accounting systems like QuickBooks and looking for more sophisticated systems like NetSuite and Sage. And Docyt fits in in that space as well, extending the life of QuickBooks for such business owners so they don’t have to change their systems.”

In its earliest days, Docyt was a secure document sharing platform with a focus on mobile. Some of this is still in the company’s DNA, with its focus on being able to pull in financial documents and then reconciling that with a business’ bank transactions. While other systems may put the emphasis on transaction data, Docyt’s emphasis is on documents. That means you can forward an emailed receipt to the service, for example, and it can automatically attach this to a financial transaction from your credit card or bank statement (the service uses Plaid to pull in this data).

For new transactions, you sometimes have to train the system by entering some of this information by hand, but over time, Docyt should be able to do most of this automatically and then sync your data with QuickBooks.

“Docyt is the first company to apply AI across the entire accounting stack,” said Amit Sridharan, founding general partner at First Rays Venture Partners. “Docyt software’s AI-powered data extraction, auto categorization and auto reconciliation is unparalleled. It’s an enterprise-level, powerful solution that’s affordable and accessible to small and medium businesses.”

Panoply, a platform that makes it easier for businesses to set up a data warehouse and analyze that data with standard SQL queries, today announced that it has raised an additional $10 million in funding from Ibex Investors and C5 Capital. This brings the total funding in the San Francisco- and Tel Aviv-based company to $24 million.

The company, which launched back in 2015, has mostly stuck to its original vision, which was always about democratizing access to data warehousing and the analytics capabilities that go hand-in-hand with that. Over the last few years, it also built more code-free data integrations into the platform that make it easier for businesses to pull in data from a wide variety of sources, including the likes of Salesforce, HubSpot, NetSuite, Xero, Quickbooks, Freshworks and others. It also integrates with other data warehousing services like Google’s BigQuery and Amazon’s Redshift and all of the major BI and analytics tools.

The company says it will use the new funding to expand its sales and marketing efforts.

“We aspire to make analysts’ lives simpler and more productive by making it easier for them to sync, store, and access their data, and this funding will go a long way toward that mission,” says CEO and co-founder Yaniv Leven in today’s announcement.

In some ways, Panoply was maybe just a bit early to the market. Today, though, there can be little doubt that we’re in a booming market for data warehousing and analytics services. There’s nary a business left, after all, that isn’t looking to gain more insights from the copious amounts of data they gather every single day now. That market is now more competitive than ever, too, with incumbents like Snowflake, Databricks and others (including all of the hyper clouds) all aiming for their slice of the market. Panoply and its investors clearly believe that the company’s all-in-one platform gives it a competitive edge, though.

This is it, startup fans. It’s your very last chance to scoop up the few remaining tickets to our 3rd Annual Winter Party at Galvanize — the best Silicon Valley startup soiree bar none. If you want to join this fun gathering of 1,000+ likeminded startuppers on February 7, you’d best act quickly. Exhibitor tables have long sold out. Don’t get left behind — buy your ticket now before they’re gone for good.

A big shout out to our sponsors Calgary, Uncork Capital, Brex, Galvanize and Snap Fiesta for helping us throw this bash. You’re in for an unabashed night of fabulous food, delicious drinks and festive foolishness. Time to loosen your collar and network in a relaxed setting with some of the Valley’s brightest entrepreneurs, founders and investors — attendees span the entire startup ecosystem.

You never know when a casual conversation could develop into a serious opportunity, and TechCrunch parties have a strong track record for making startup magic.

Here are just five of the many companies with whom you can meet and greet — talk about an opportunity to connect: Deloitte, Perkins Coie, Ceres Robotics, Samsung, Okta, Facebook. And while you’re at it, don’t miss meeting the 10 outstanding startups that will exhibit their tech and talent. More connections equal more opportunity.

Here’s the essential 411 on the party details:

As always, you’ll find plenty of fun. Bust out your karaoke skills, play games, and plenty of photo ops will let you light up your Insta. You might even win one of the many door prizes including TC swag and free passes to Disrupt SF in September 2020.

The 3rd Annual Winter Party at Galvanize takes place in just three days. We have only a few tickets left, so don’t waste another minute. Buy your ticket today and come join the fun!

Is your company interested in sponsoring the 3rd Annual Winter Party at Galvanize? Contact our sponsorship sales team by filling out this form.

You better move fast if you want to party with us and 1,000 of your closest startup entrepreneur and investor friends. We just released a fresh round of tickets to our 3rd Annual Winter Party at Galvanize in San Francisco on February 7. Tickets are limited, and they fly off the shelf faster than you can say seed funding. Don’t get shut out — buy your tickets here.

What can you do at the Winter Party? Plenty. Commune with the Silicon Valley community over craft beer and signature cocktails. Nosh on delectable appetizers. Converse and connect in a fun, relaxed setting. You never know who you’ll meet, but you can be sure to find influencers eager to meet and greet.

Demo your startup and introduce your genius product to the Valley’s finest thinkers, makers and investors. We have a very limited number of tables available — only two demo tables left — so get cracking. FYI: the price of a demo table includes four tickets to the party. Bring your crew and maximize your networking mojo.

What else goes down at the Winter Party? Lots of laughter, party games and activities — killer karaoke, anyone? — and plenty of photo ops. You might even score door prizes, like TC swag and tickets to Disrupt SF, our flagship event coming in September 2020. We’ll toss in a few surprises that night, too. Sweet!

Here’s the Winter Party lowdown.

Remember, we release tickets in batches. If you don’t score a ticket this time, keep your eyes peeled for the next round. Don’t miss out!

Come to the 3rd Annual Winter Party at Galvanize and hangout with your people. Enjoy the food, the drinks, the fun and the opportunity to expand your network in a relaxed setting. We’ll see you in February!

Is your company interested in sponsoring or exhibiting at the 3rd Annual Winter Party at Galvanize? Contact our sponsorship sales team by filling out this form.