When we penned the intro for this piece last year, little did we know that — in many ways — we’d still be deep in it by the time 2021’s feature rolled around. Amid another holiday season marred by a new variant, seemingly the more things change — well, you get the picture.

Surprisingly, however, in spite of the fact that we’re still very much in the throes of a global pandemic, 2021 hasn’t been punctuated by as many high-profile losses in the startup world as the year prior.

Perhaps the first year of the pandemic was simply the final straw for so many companies that were already treading water — or maybe an influx of capital sources has kept heads above water. Some companies successfully pivoted and others were born as a direct result of a world forever changed because of COVID-19.

2021 also largely lacked the kind of blockbuster crashes we saw last year, courtesy of names like Quibi and Essential. But even in a non-pandemic year, keeping a startup afloat is still an enormously difficult task, and not everyone managed to make it to the New Year unscathed.

Total raised: $12 million

Image Credits: Abundant

This is a major sputtering in what has been an otherwise remarkable year for robotic startups. In a certain sense, Abundant was ahead of the curve on agtech robotics, which can often be more curse than blessing. Barely two years after rolling out its first commercial deployments, the apple-picking robotics firm quietly closed up shop. Over the years, the company managed to raise $12 million, including a $10 million Series A led by GV (Google Ventures) back in 2017.

Farmers are taking a long, hard look at robotics and automation to help ease the strain of continued labor shortages. Companies like John Deere are investing a lot in homegrown solutions and acquisitions. It seems very much within the realm of possibility that we’ll see more widescale picking robots deployed sooner than later, but the main question at the moment is from whom?

In October, it was reported that Waverly Labs had acquired Abundant’s IP, meaning that its technology may still live on in some form.

Image Credits: Chanje

In November 2018, TechCrunch reported that FedEx was working with a relatively new and unknown startup as it ramped up its efforts to electrify its fleet of delivery vans. The company announced plans to add 1,000 electric delivery vehicles from Chanje Energy, a California-based and China-backed startup founded in 2015. In subsequent years, Chanje came to be known for its practice of importing electric delivery vans from China and selling them to companies like FedEx, Ryder and even Amazon. FedEx and other customers were left in the lurch when the electric vehicle company reportedly “quietly folded” sometime this year, The Verge reported on December 15. CEO Bryan Hansel (described by some employees as both “charismatic” and “narcissistic,” had partnered with a Chinese company that went bankrupt. Hansel reportedly worked hard to convince investors to buy pieces of that company so that Chanje could keep operating, but to no avail. According to The Verge, he fired the last of Chanje’s employees the Friday before Memorial Day weekend.

Chanje reportedly still owes “many” of its former employees months of back pay and promised bonuses, with at least four having filed suit against the startup. Ryder also sued the company for more than $3 million after Chanje did not deliver most of the vans it promised to the fleet company. Meanwhile, FedEx never got the 1,000 electric vans it expected from Chanje from that 2018 deal. That led to the delivery giant being forced to abandon a project to build out charging infrastructure at FedEx depots across California. While FedEx is also suing the company in an effort to get back some of the millions of dollars it had spent on that charging infrastructure, its prospects are bleak.

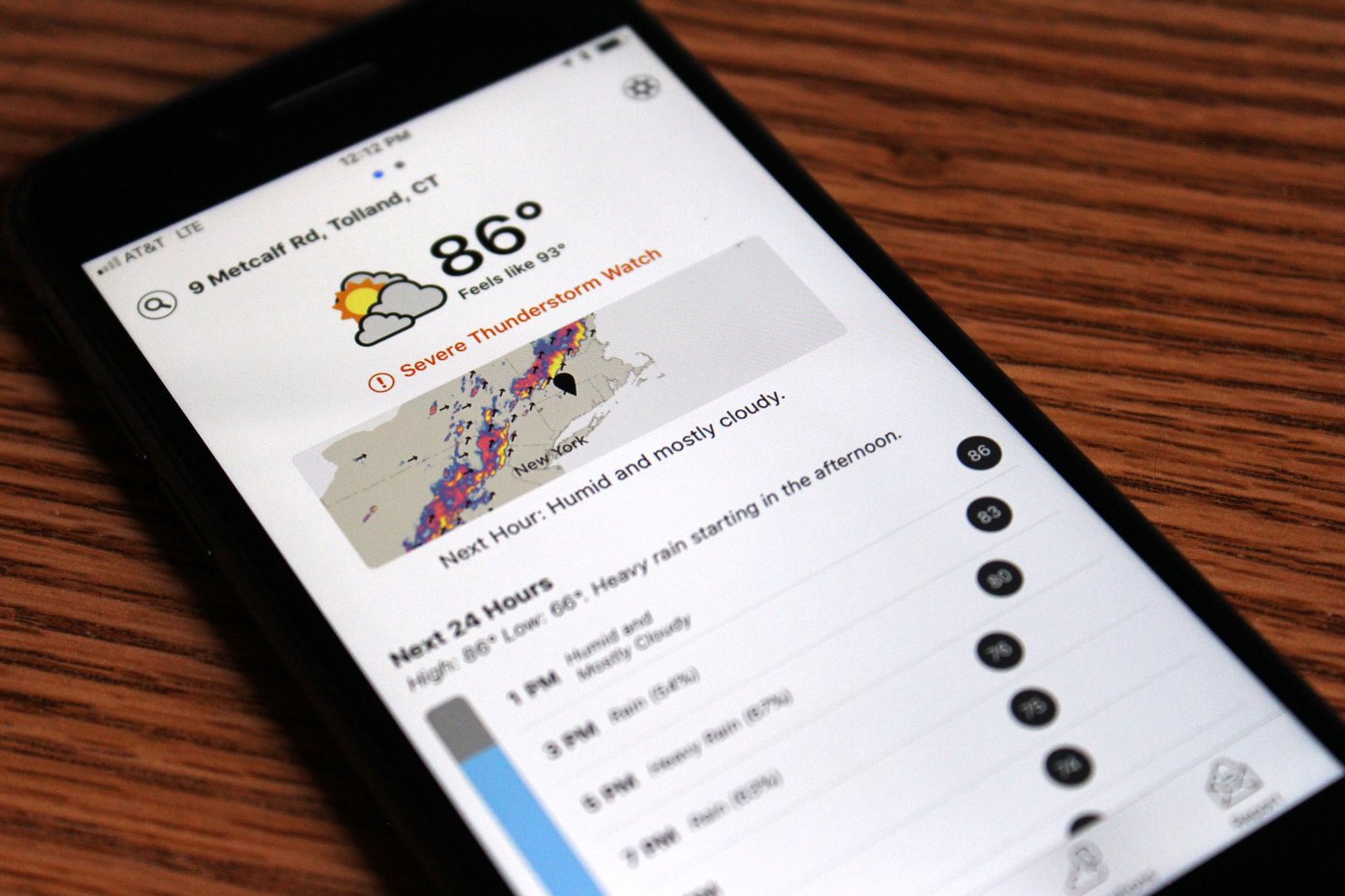

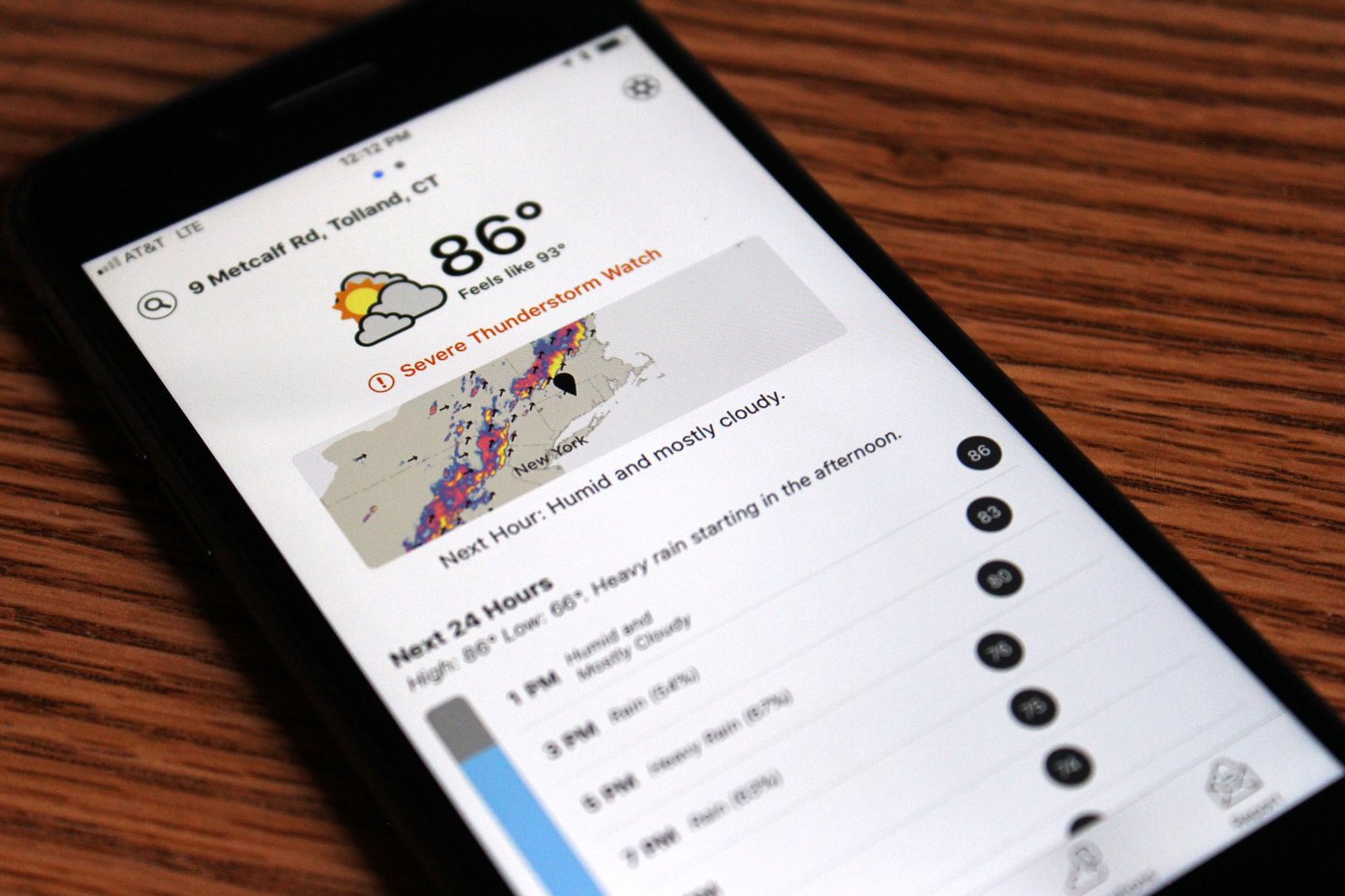

Image Credits: Dark Sky

In March of 2020, Apple acquired the Dark Sky weather app, which was popular for its hyperlocal focus. Clearly the tech giant was interested in its features, many of which it incorporated into the iPhone weather app. From the get go, Apple had made clear that the Android app would shutter that July. The fate of the iOS app and API service, however, remained fuzzy. (The API service allowed other developers to tap Dark Sky’s database of “weather forecasts and historical weather data.”)

By June of 2021, the iOS app and API service officially had expiration dates, with co-founder Adam Grossman writing: “Support for the Dark Sky API service for existing customers will continue until the end of 2022. The iOS app and Dark Sky website will also be available until the end of 2022.” While this was not an explicit shutdown announcement, it was certainly implied.

Total raised: $2 billion

Image Credits: Katerra

There was a time that Katerra was considered the darling of the construction tech world. Some argue it made prefab construction more mainstream — and cool. As it grew, Katerra ambitiously wanted to own the tech stack around a construction project, whether it be office buildings or apartments. But by the end of 2020, signs of serious problems emerged. The startup was said to be on the verge of filing for Chapter 11 bankruptcy when Japanese investment conglomerate SoftBank swooped in with a $200 million bailout. But it was too little, too late. Katerra’s vertically integrated approach couldn’t keep up with rising labor and construction costs and the company was struggling with delays and cost overruns on some projects, while the COVID-19 pandemic delayed others. Irregularities that the company discovered in accounting practices also added to headaches, according to The Wall Street Journal.

So it was not a huge shock when on June 1, 2021, Kattera was reported to be officially shutting down (The Information broke the news) after burning through more than $2 billion in funding. Founded in 2015, Katerra had at one point been valued at $4 billion and employed more than 8,000 people. When it shuttered, it was believed to have had around 2,400 employees. The failure marked the second high-profile SoftBank-backed proptech that struggled in recent years (WeWork was the first). While there were concerns that Katerra’s implosion might affect faith in the construction tech industry as a whole, the year still saw a number of large fundings in the space.

Image Credits: Alphabet

Alphabet’s Loon flew high over the course of its nine-year run, only to come crashing back down to earth earlier this year. Two-plus years after spinning off the X graduate, the company grounded the project aimed at bringing internet connectivity to underserved areas via balloon. Loon CEO Alastair Westgarth noted in a blog post that the project simply wasn’t able to achieve profitability.

“While we’ve found a number of willing partners along the way, we haven’t found a way to get the costs low enough to build a long-term, sustainable business,” he wrote. “Developing radical new technology is inherently risky, but that doesn’t make breaking this news any easier.”

Loon said its technologies would continue to live on, having already been adopted by outfits like Project Taara, another Alphabet X moonshot aimed at delivering high-speed internet through light transmission. In September, Alphabet passed an additional 200 patents along to SoftBank, which plans to execute on them as part of its High Altitude Platform Stations (HAPS) business. Fellow high-flying moonshot Wing, on the other hand, continues to gain steam.

Image Credits: TechCrunch

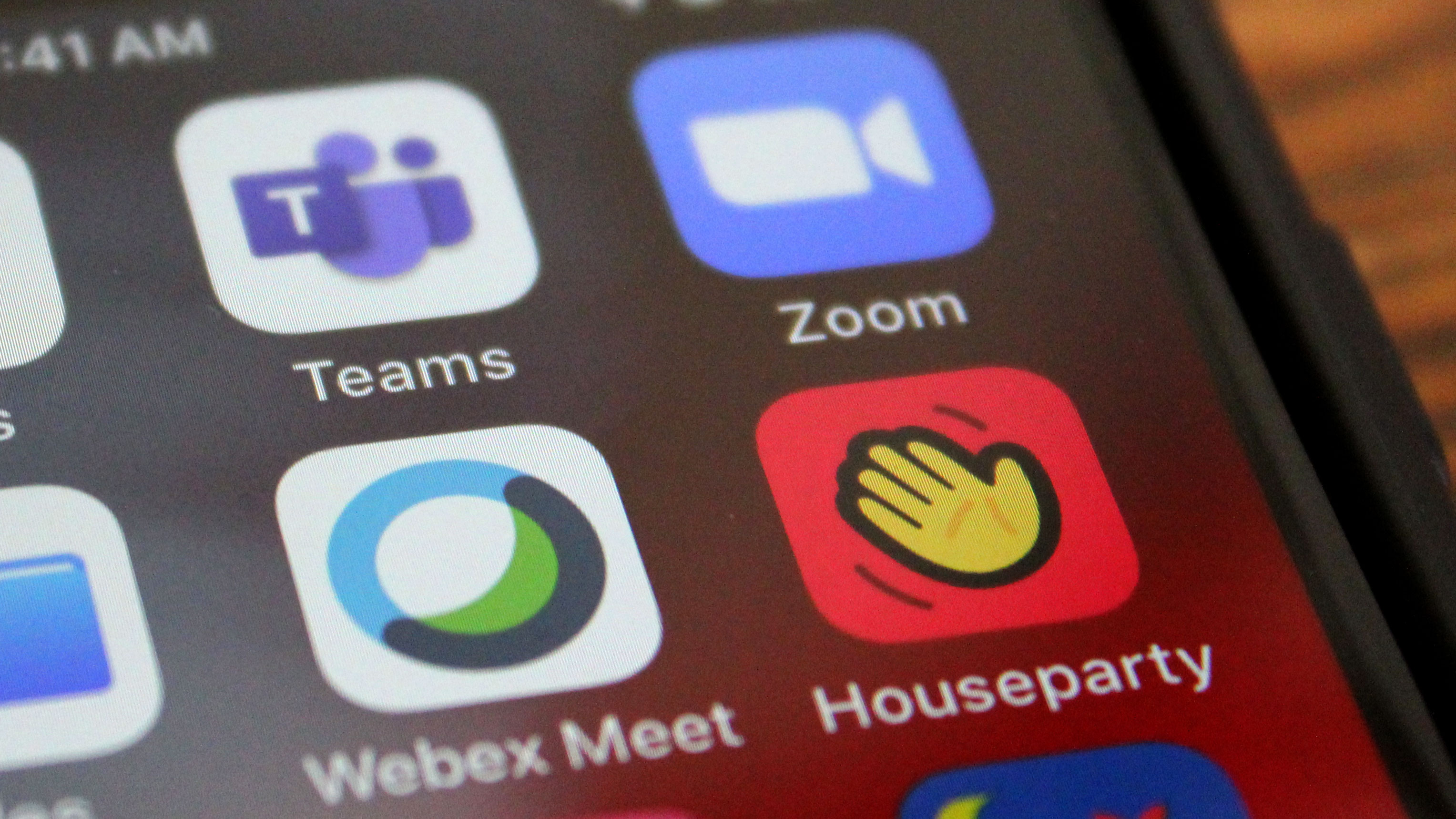

Before Houseparty sunsetted, it soared. In the early innings of the pandemic, the social video chat app claimed that it was landing 50 million new signups a month, as humans sought virtual connection amid quarantine. Fast-forward to today, and it seems that Houseparty’s pandemic bump didn’t help the company stay relevant. In September, Epic Games announced that it was shutting down Houseparty in October, a little over two years since it first acquired the company for a reported $35 million.

There are a variety of potential reasons as to why the once-booming app was shut down, from the rise of Clubhouse to the inevitable fatigue from Zoom. In a thread announcing the shutdown, Houseparty CEO and co-founder Sima Sistani hinted it was simply a strategy shift.

“The metaverse vision and products we’re working on at [EpicGames] are also about shared experiences, but in a more rich form than 2D video — one that’s better positioned to shape the next generation of the internet,” Sistani wrote.

Houseparty will live on as the core of Fortnite’s voice chat and within larger projects in the Epic Games metaverse.

Pearl Automation, an automotive accessory startup, shuttered just a year after launching out of stealth mode. Founded by former Apple engineers, Pearl debuted with a wireless rear-view camera and already began shipping out its products, which cost $499.99.

“Once connected, the RearVision app in landscape will show you a full-screen view of what the cameras in the license plate holder is seeing, with a 175-degree viewing angle,” reporter Darrell Etherington wrote in a 2016 review of the product. “You can toggle between the full fish-eye experience, or a warp-corrected view that fills the display corner-to-corner with the space behind your car. You can also pivot the view up or down to get a better look at more of the sky, or more of the ground as needed.”

While Etherington liked the industrial design and minimal software of the product, he noted that it is a premium device which needed upgrades: “It’s still for a specific subset of users — those who value quality and craftsmanship and are willing to pay for it, but who also don’t have a modern vehicle with its own backup camera, and don’t plan on getting one anytime soon.” This year, it seems like that subset wasn’t enough to keep the company going.

Per Axios, the shutdown was a result of disappointing product sales and a high burn rate, despite the fact that Pearl Automation had raised $50 million in venture capital funding. Investors included Accel, Venrock, Shasta Ventures and Wellcome Trust, according to Crunchbase.

Honorable Mentions

DALLAS, Feb. 26, 2021 — A closed Fry’s Electronics store is seen in Plano, Texas, the United States, Feb. 25, 2021. U.S. electronics store chain Fry’s Electronics is permanently closing all of its stores, the company announced Wednesday. The company said in a statement on its website that it “made the difficult decision to shut down its operations and close its business permanently” because of changing consumer shopping habits and the ongoing COVID-19 pandemic. Fry’s Electronics had 31 stores across nine U.S. states. (Xinhua/Dan Tian via Getty Images)

Mea culpa. This one’s not a startup, but it would still feel weird to do a list without it. The Februrary closure of the Bay Area-based electronics chain left a massive Egyptian (or, perhaps, Mayan) pyramid-shaped hole in the hearts of many who grew up wandering its aisles. For me, it was the Fremont store, whose 1893 World’s Fair theme didn’t make for a particularly exciting exterior, but the indoor Tesla coil did the trick.

In an Amazon-ruled world devoid of Circuit Cities, where RadioShack is a shadow of its former self, it’s frankly amazing that this strange, beautiful beast held on for as long as it could. At its peak, Fry’s boasted 34 giant stores across nine states. But ultimately, COVID-19 was the final nail in the already troubling environment of brick and mortars. It’s a testament to just how big these big box stores were that their former homes are dealing with zoning headaches in their wake.

Image Credits: Joan Cros/NurPhoto / Getty Images (Image has been modified)

Unlike other pandemic-fueled losses over these past two years, the death of LG’s mobile division was a long time coming. The South Korean electronics giant simply couldn’t keep up in a market dominated by Samsung, Apple and, increasingly, manufacturers in China. In April, LG announced its exit from phones in order to spend more time with TVs and other smart home products.

Image Credits: Bryce Durbin / TechCrunch

And so rare its vision truly was. When founders Jacob Claerhout and Boris Gordts launched Visionrare, they combined two trends: the gamification of investing and the surging interest around NFTs. The end result was a platform in which users could bid for NFT shares of different startups, stacking up a fake portfolio that they could then compete against others with. It even got some Y Combinator startups on board.

Crypto angle aside, Visionrare’s pitch was interesting. The fake stock market could get non-accredited investors a track record in betting on startups, and one day “serve as a signal for VCs looking for their next hires.”

If you think it sounds buzzy, some entrepreneurs and investors had a different word: illegal. Some questioned whether the platform was legal or if it was an investment security, pushback that ended up causing the co-founders to shut down the paid marketplace due to underestimating “the legal complexities” with selling novelty NFT shares in real startups.

Crypto marketplaces aren’t controversial, but Visionrare’s approach to the burgeoning sector rang alarm bells. And that doesn’t happen as often as you’d think. Nonetheless, the founders promised to relaunch the company soon. Their LinkedIn’s show that they are continuing to work together, and are “building something new.”

Nearly a decade ago, Friendster’s Jonathan Abrams launched Nuzzel, a social news reading service that highlights headlines that are being read and shared by friends in your network. The simple yet savvy startup soon attracted a loyal user base, especially for Twitter users who wanted a more personalized timeline. According to Crunchbase, Nuzzel had raised $5.1 million from investors, including Salesforce CEO Marc Benioff.

In 2019, Nuzzel was acquired by Scroll, which wanted to bring aggregation and curation to its subscription service. While no one from Nuzzel’s original team joined Scroll in a full-time capacity, the app continued to function as is — until this year, of course. Twitter scooped up Scroll in May and simultaneously shut down Nuzzel. In a blog post that has since been removed, Nuzzel’s team explained that the product needed to be rebuilt in order to scale with Twitter.

“To those of you who love Nuzzel and are disappointed that we can’t maintain Nuzzel as-is in the interim, I’m as disappointed as you,” Scroll CEO Tony Haile said in the now-deleted post. “We explored any number of Hail Marys to make that happen and just couldn’t get there. Looking to the future, Nuzzel’s functionality has always felt like it should be a part of Twitter and I’m excited to help make it so.”

Months later, some good news: While Nuzzel as we know it has ceased to exist, Twitter brought back one of the app’s most-loved features, Top Stories, in the debut of its premium subscription service Twitter Blue.