Soon after launching Ocho, a startup offering personal finance support for business owners, Ankur Nagpal realized that the company’s debut product – a solo 401(k) retirement account – “is not a venture-backed business” in and of itself. Despite landing nearly 300 customers with that initial wedge, the entrepreneur is already focused on broadening the service to become more holistic, and for business owners just trying to figure out how to think about money, more realistic.

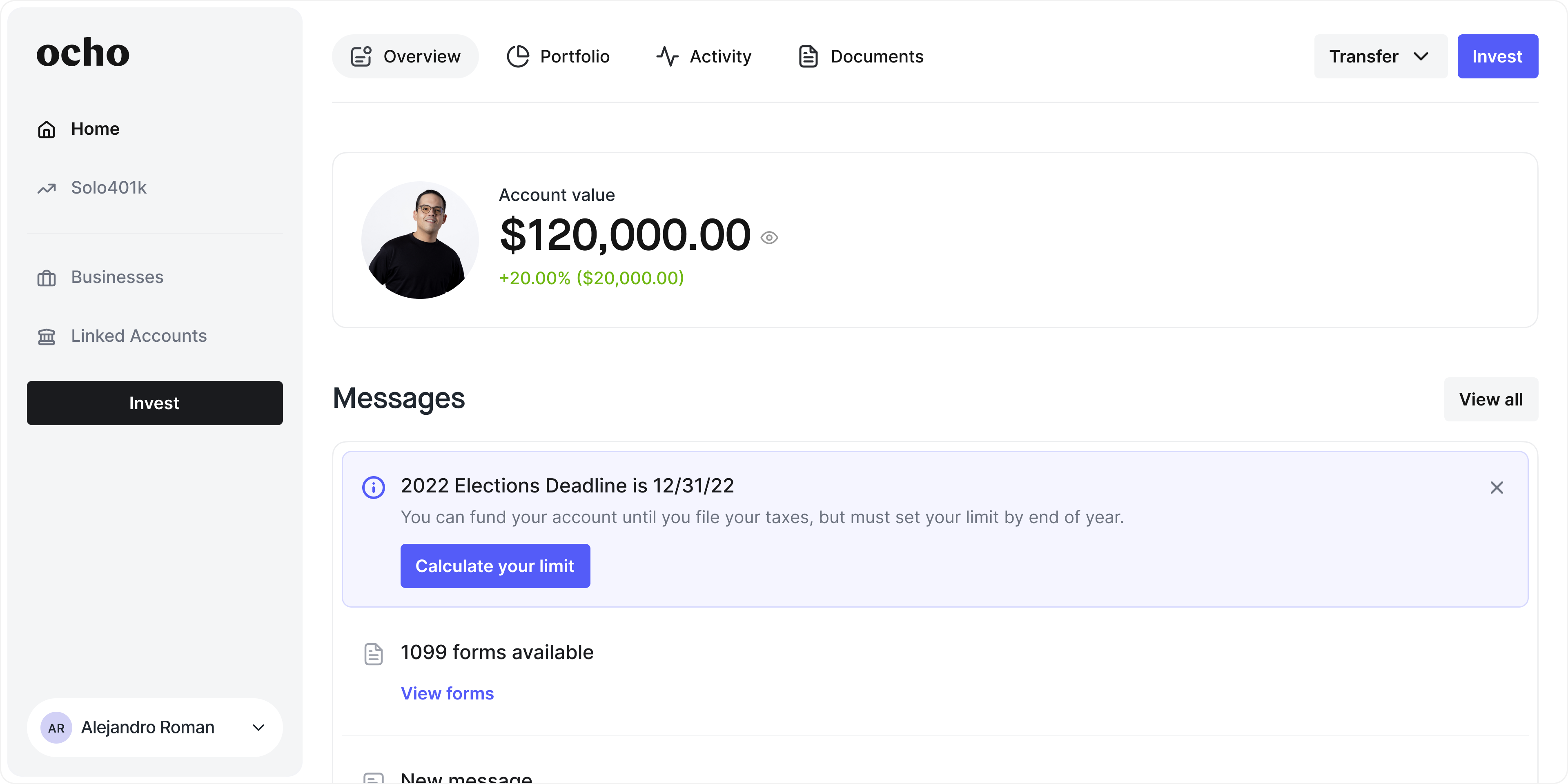

“We still haven’t found a single user that feels confident or comfortable with their financial knowledge,” Nagpal said. Alongside solo 401(k) services, Ocho is now a brokerage that allows people to invest in a variety of ETFs and stocks, has financial advisor support services, and is working on offering other types of accounts such as IRAs and health savings accounts.

Robinhood, he says, is often an app associated with buying and selling. He hopes that Ocho, because it’s for retirement, is all about “buying and holding.” Ocho is extremely focused on education and conservative bets. There will never be options trading the platform. “We’re being very conservative – for example if someone wants to buy Apple shares on our platform, of course they can. But we’ll also ask them to consider buying an index fund before doing that just because historically that’s been a safer option.”

“Ideally we’re a lot more boring,” Nagpal said, compared to Robinhood. “In an ideal world I would love with someone you know, set up a bunch of like automations to like, automatically invest some percentage of their paycheck and we will handle the rest. There’s not a lot of active trading.” The company only makes money from a $299 per year annual subscription fee.

The refrain of being an “all in one solution” is all too common in the fintech world, as companies pivot and broaden their services to land a bigger scale. Ocho wants to avoid some of that rate race, especially around customer acquisition costs.

Ocho is also having discipline around one very specific budget: the company has spent $0 on paid marketing, and plans to keep it that way for the next few years. Nagpal also added that the 9-person team likely won’t hire anyone new this year, and they continue to work with freelancers and contractors to manage demand without overspending.

For now, is looking to land customers and brand trust through offering equity to some of the biggest tech influencers and builders in the space. Nagpal tells TechCrunch that Ocho has raised a $4.5 million seed round led by Vibe Capital, which is Nagpal’s own venture fund. He says he got approval from all of his LPs and the round was closed at a $12 million valuation. The round also includes investments from over 200 techies, including Mercury’s Immad Akhund, AngelList’s Avlok Kohli and Elizabeth Yin’s Hustle Fund. Each investor was only allowed to contribute up to $10,000 maximum, which Nagpal says was key in helping them create an “army of stakeholders and supporters and people that are vested in our success.”

If you have a juicy tip or lead about happenings in the venture world, you can reach Natasha Mascarenhas on Twitter @nmasc_ or on Signal at +1 925 271 0912. Anonymity requests will be respected.

This fintech startup ideally wants to be ‘a lot more boring’ than Robinhood by Natasha Mascarenhas originally published on TechCrunch